Beef 2020 Export Highlights

Top 10 Export Markets for U.S. Beef(values in million USD) |

|||||||

| Country | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 % Change | 2016-2020 Average |

| Japan | 1,510 | 1,889 | 2,102 | 1,950 | 1,944 | 0% | 1,879 |

| South Korea | 1,071 | 1,220 | 1,746 | 1,843 | 1,722 | -7% | 1,520 |

| Mexico | 977 | 979 | 1,058 | 1,107 | 853 | -23% | 995 |

| Canada | 758 | 791 | 745 | 654 | 728 | 11% | 735 |

| Hong Kong | 684 | 884 | 964 | 746 | 666 | -11% | 789 |

| Taiwan | 363 | 409 | 552 | 568 | 552 | -3% | 489 |

| China | 4 | 31 | 61 | 86 | 310 | 260% | 98 |

| EU27+UK | 247 | 252 | 231 | 193 | 153 | -21% | 215 |

| Indonesia | 39 | 54 | 62 | 85 | 72 | -16% | 62 |

| Philippines | 55 | 62 | 87 | 88 | 62 | -29% | 71 |

| All Others | 579 | 660 | 760 | 736 | 694 | -6% | 686 |

| Total Exported | 6,360 | 7,263 | 8,357 | 8,095 | 7,649 | -6% | 7,545 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2020, the value of U.S. beef & beef product exports contracted 5.5 percent year-over-year, largely due to supply chain constraints and foodservice struggles in the wake of the COVID-19 pandemic. Japan at $1.9 billion, South Korea at $1.7 billion, and Mexico at $853 million accounted for 59 percent of total U.S. sales. Mexico’s beef imports from the United States decreased due to its economic slowdown and an unfavorable exchange rate relative to the U.S. dollar. U.S. exports to Japan, the No. 1 market, remained flat from the previous year. The effects of additional exports to Japan early in 2020 were negated by a drastic decline in the second quarter after COVID-19 became more widespread. Exports of U.S. beef to China increased due to China’s removal of market access barriers pursuant to the Phase One Agreement and strong meat demand in China due to reduced domestic pork supplies. Overall, exports accounted for 11 percent of U.S. domestic production. The United States was the world’s largest beef producer, second-largest importer, and third-largest exporter by volume.

Drivers

- On January 1, Japan leveled the playing field for U.S. beef by relaxing tariffs on par with competitors who are part of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP).

- China’s removal of market access barriers spurred U.S. beef exports, yet U.S. beef only accounted for 2 percent of China’s total beef imports and 4 percent of U.S. sales.

- Exports to Mexico dropped sharply in the second quarter, due to weak demand from the hotel, restaurant, and institutional sector amid a deep recession.

- South Korea’s imports of U.S. beef slowed due to an increase in domestic production and temporary restrictions on dining out.

- Total beef & beef product exports to the Philippines and Indonesia were down 23 percent in 2020 due to limited operations of the food service sector in both countries.

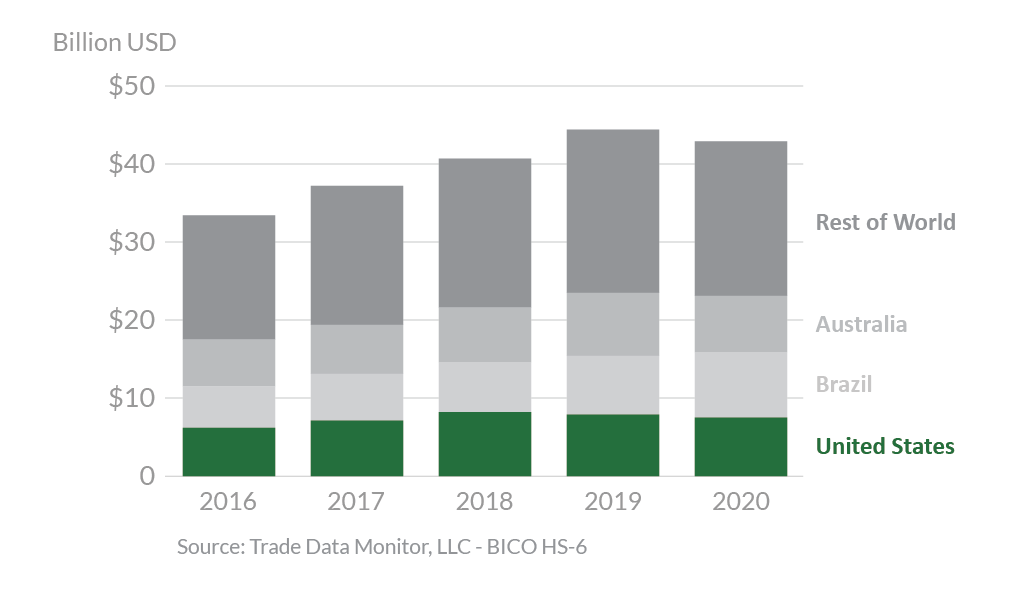

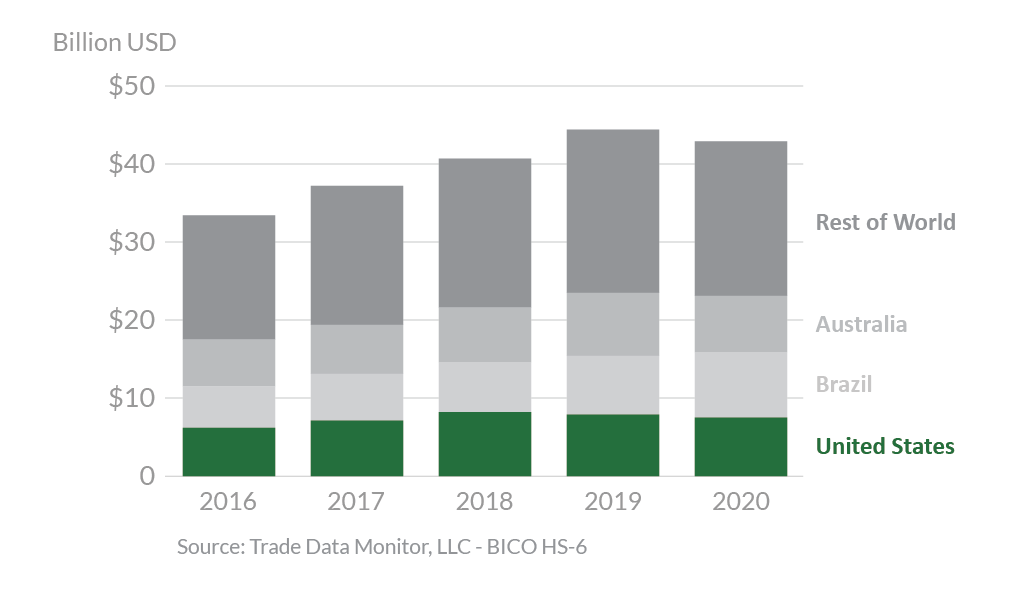

Global Beef Exports

Looking Ahead

For 2021, U.S. beef & beef product exports are forecast to rebound on a volume basis with the global economic recovery and relaxed pandemic measures spurring demand in most markets. Australia, a top U.S. competitor, continues to rebuild its herd and its cattle slaughter is projected to fall to record lows, enabling U.S. beef to expand market share in Asia.

However, U.S. exports may face short-term challenges. The United States continues to face barriers in China, including the absence of a maximum residue limit for the animal feed additive, Ractopamine.

The United States is projected to continue as the world’s largest beef producer, second-largest beef importer, and second-largest beef exporter, overtaking Australia..