Executive Summary

Japan has a well-developed food retail market that demands high-quality, high-value agricultural and food products. Despite reduced economic activity during the COVID-19 pandemic, trade data show that agricultural imports have remained resilient. As Japan’s top supplier of agricultural products, the United States is a stable and reliable partner with a long-standing relationship. Although competition in Japan has intensified in recent years, U.S. suppliers can find many opportunities to market consumer-oriented products that follow Japanese retail trends. The U.S. Department of Agriculture’s (USDA) Foreign Agricultural Service (FAS) maintains a website1 to help U.S. food and beverage exporters to navigate the Japanese market: USDAJapan.org.

Macroeconomic Perspective

Japan is a high-income country with a population of 125.7 million people.2 It is one of the most highly urbanized countries in the world with more than 90 percent of the population living in urban areas. With the third-largest economy in the world, behind only the United States and China, Japan has a highly diversified manufacturing and service economy. According to household data from IHS Markit, 95 percent of Japanese households, approximately 51.6 million households, have incomes higher than $20,000 at purchasing power parity. In 2021, Japan had a gross domestic product (GDP) per capita at purchasing power parity of $42,940. According to the latest International Monetary Fund forecast, real GDP growth is projected at 1.6 percent in 2023 and 1.3 percent in 2024.

Since the initial response to the COVID-19 outbreak in 2020, the Government of Japan’s containment measures and consumers’ risk-averse behaviors limited economic activity. However, in the third quarter of 2022, Japan loosened border controls, boosting economic activity and seeking to reconnect with the world. Since October 2022, visa-free tourism resumed for U.S. citizens (see GAIN report JA2022-0112 for more information on Japan’s reopening). While Japan’s economic recovery continues, challenges remain. Japan’s lack of natural resources, including agricultural land, makes the country susceptible to external pressures such as food and energy prices. For example, price shocks from Russia’s war in Ukraine and supply chain disruptions have impacted domestic purchasing power. Increased prices have subdued household confidence and real income. Also, from a demographic perspective, Japan not only has an aging population but also a declining population. This trend continues to limit economic growth and presents fiscal policy challenges.

Japan and Agricultural Trade

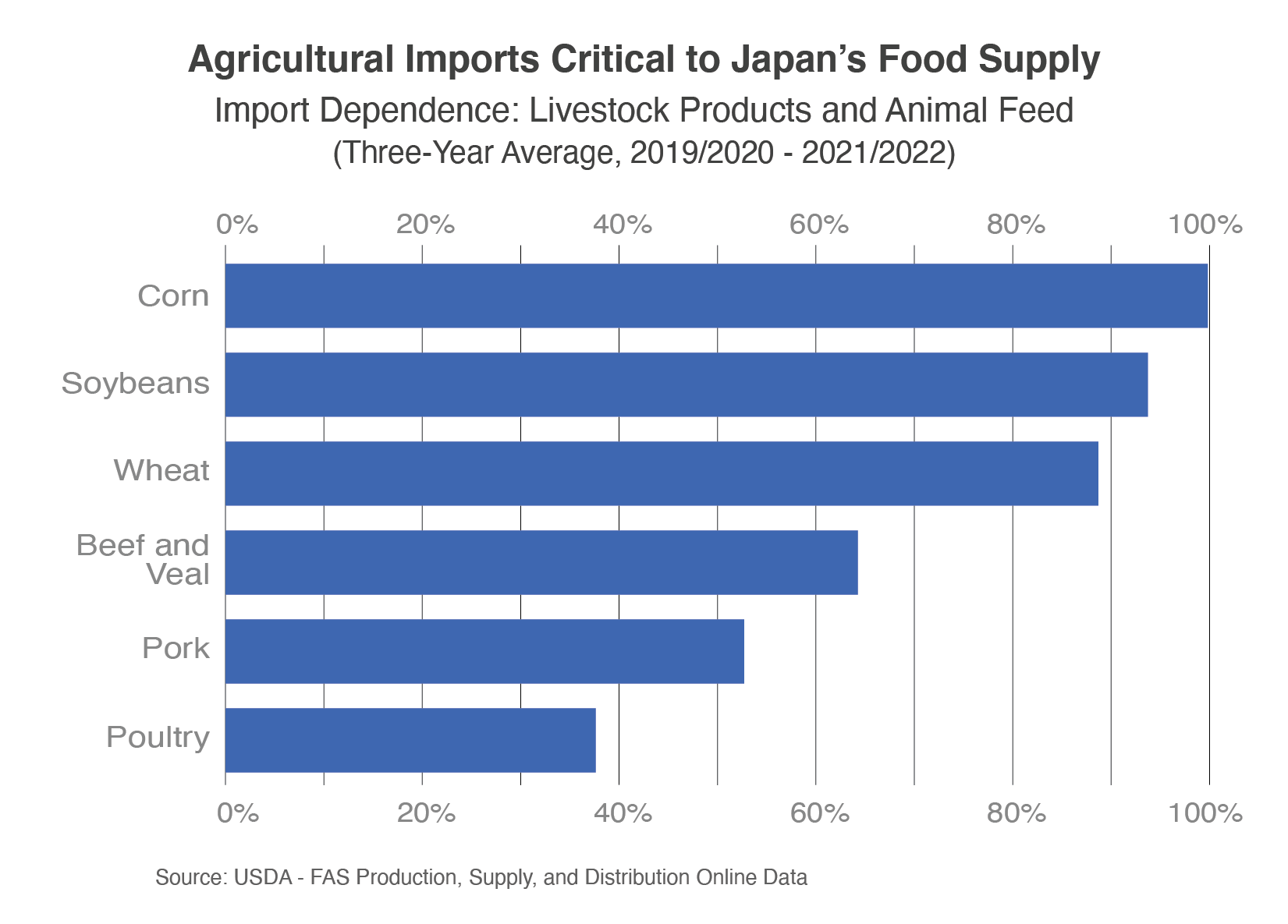

Despite various challenges and an uncertain global economic environment, Japan’s agricultural trade, particularly agricultural imports, has been resilient because these imports play a crucial role in Japan’s domestic food supply. According to Japan’s Ministry of Agriculture, Forestry and Fisheries annual report, Japan’s food self-sufficiency ratio on a caloric basis was 37 percent in 2020, suggesting that many food items depend on imports to boost food availability. In particular, imported livestock products and animal feed supplement Japan’s limited domestic agricultural production.3

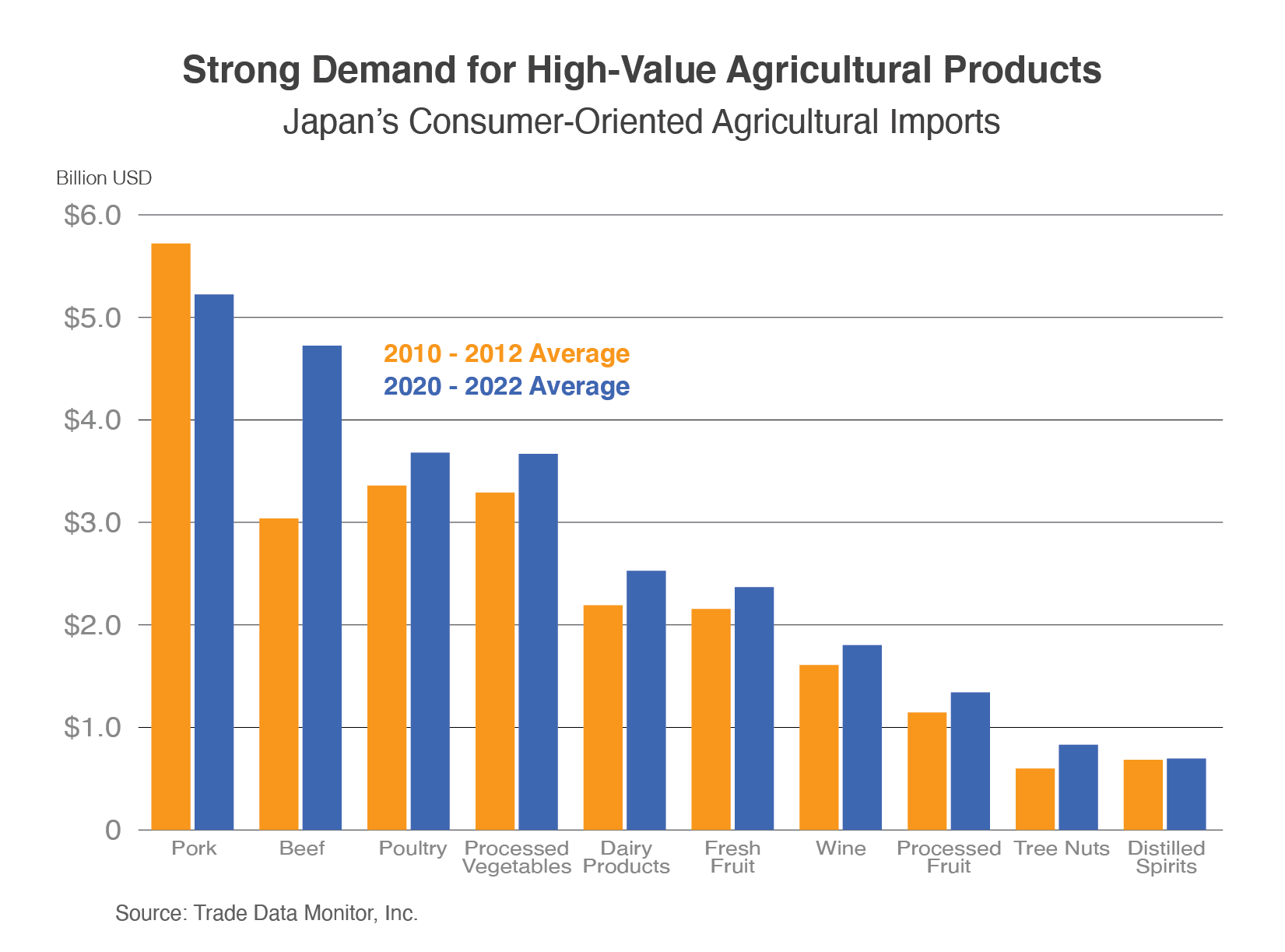

In 2022, Japan imported $70.2 billion of agricultural products, a 16.4-percent increase from pre-COVID 2019 and also surpassing record-level agricultural imports of 2011 and 2012. Although rising food prices contribute to higher unit prices, putting downward pressure on real income and purchasing power, Japan is an advanced economy where demand for high-quality food is relatively stable compared to emerging economies.

The United States is a dependable agricultural trading partner of Japan. Despite supply chain disruptions and economic shocks from the COVID-19 pandemic, the United States has continued to supply safe, high-quality agricultural products. With the implementation of the 2020 U.S.-Japan Trade Agreement (USJTA), U.S. agricultural exporters remain competitive, from a tariff perspective, with Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) member countries. However, macroeconomic conditions, including Japan’s economic recovery and exchange rate dynamics, affect U.S. export competitiveness. As the U.S. dollar strengthened during 2021 and 2022, U.S. exports to Japan became more expensive. However, since October 2022, the Japanese yen has rebounded somewhat, increasing purchasing power for Japanese importers.

As Japan’s top agricultural supplier, the United States exported $14.6 billion of agricultural products in 2022, with consumer-oriented products making up almost half ($6.8 billion) of the agricultural exports. Japan was the fourth-largest market for U.S. consumer-oriented products.

Exports Opportunities for Consumer-Oriented Products

Japan’s highly developed food retail market allows consumers to have several options to meet their food needs, whether it is dining at a restaurant, shopping at supermarkets and convenience stores, or retailing via e-commerce, where customers have quality groceries and food delivered to their doorsteps. Customers continue to seek out high-quality food, emphasizing convenience and accessibility, such as ready-to-eat meals and on-the-go packaged food. Also, Japan’s demographic shift has opened the door for increased demand for health food. Japan’s older population generally has more spending power and influence regarding household consumption patterns, and the health-conscious population are willing to pay more for high-quality, nutritious foods (see U.S. Japan Organic Equivalence Arrangement for more information regarding shipping organic products to Japan). Food products that consumers believe support health and dietary and functional needs are promising for the foreseeable future.

In October 2019, the United States and Japan signed the USJTA, which provides for limited tariff reductions and quota expansions to improve market access. Japan agreed to reduce or eliminate tariffs on about 600 agricultural tariff lines (e.g., beef, pork, and cheese), and expand preferential tariff-rate quotas for a limited number of U.S. products (e.g., wheat). Opening Japan’s highly protected agriculture market and reaching parity with exporters from Japan’s free trade agreement partners was a major priority for the U.S. agriculture sector.

Consumer-oriented goods with strong prospects for growth include the following:

Beef and Beef Products: Despite higher beef retail prices, beef shipments to Japan in value and shipment volumes have remained steady. Higher prices may shift consumer preferences from fresh or chilled beef to frozen beef, or from beef products to pork and poultry products. However, beef consumption is expected to increase in 2023 as Japan’s reopening to foreign visitors further supports the hotel, restaurant, and institutional (HRI) sector’s recovery. As a result of the recently revised agreement with Japan regarding the beef safeguard mechanism, U.S. beef exports are less likely to trigger safeguard tariffs in the coming years even with increased shipments. In 2022, the United States exported $2.3 billion of beef and beef products to Japan, nearly matching the previous year’s record of $2.4 billion.

Cheese: The United States exported $231.8 million of cheese products to Japan in 2022, a 23.4-percent increase from a year ago. Prior to the COVID-19 pandemic, cheese products were generally marketed and consumed in dining options outside of the home. However, consumers taking advantage of expanded retail options in supermarkets during the pandemic have continued to consume cheese products beyond the stay-at-home period. According to cheese consumption data from the Agricultural Trade Office at the U.S. Embassy in Tokyo, Japan’s per capita cheese consumption is significantly lower than other advanced economies. From a marketing perspective, elevating the cheese consumption experience with cheese pairing guides will be important. Although the European Union (EU) suppliers enjoy a degree of marketing advantage (product differentiation) by promoting their geographical indications, import demand for most cheese products continues to rise.

Tree Nuts: In 2022, Japan imported $826.5 million of tree nuts, of which 51.0 percent (approximately $421.1 million) were from the United States. Elevated unit prices in 2022 did not negatively impact shipment volumes, suggesting that demand for tree nuts is stable. The United States almost exclusively supplies almonds and walnuts, the top two imported tree nuts (not including mixed or prepared tree nuts). Another positive development is shelled pistachios, which had a higher import value than in-shell pistachios. Japan imported $28.3 million of shelled pistachios in 2022, a 35.9-percent increase from 2021’s record-breaking imports ($20.8 million). Combined with in-shell pistachios, Japan imported $50.9 million worth of pistachios, and the United States supplies almost 90 percent of shelled and in-shell pistachios. With an image of “guilt-free” snacking, tree nuts have great potential as a stand-alone product as well as ingredients for other prepared food.

Processed Fruit: Processed (frozen, prepared, or preserved) fruits are essential ingredients in bakery products and snack foods. Although consumers have generally regarded fresh fruit as a premium product, consumers are shifting from fresh fruit to processed fruit. The link between processed fruit’s longer shelf life and perceived “freshness,” or the lack thereof, is less significant, especially among the younger generation. Also, processed fruit allows consumers to enjoy seasonal products year-round and to take advantage of many more fruit options that aren’t available from domestic production. While the United States has a strong presence in the dried fruit market (raisin and dried prune products), frozen fruit competition continues to intensify.

Distilled Spirits: After record-high imports in 2019 ($817.1 million), the premium drink market experienced decreased sales with disruptions to the HRI food service industry in 2020 and 2021. During this slump, however, distilled spirits observed a consumption trend shift, where the COVID-19-induced trend of at-home drinking made distilled spirits more accessible. As consumers seek a premium experience, whether at home or from a bar, spirits-based, ready-to-drink beverages have growth potential. Imports from the United Kingdom, for example Scotch whiskey, make up more than 60 percent of the whiskey market share, but name recognition for American whiskeys, namely bourbon and Tennessee whiskey, is growing. In 2022, U.S. whiskey exports were up 7.2 percent in value during the past year.

Looking Ahead

Japan’s declining agricultural production and evolving consumption trends indicate that agricultural imports will continue to play an integral role in meeting Japan’s food demands. Japan has emphasized import diversification and stabilization to secure food supplies, including through trade liberalization. Accordingly, Japan signed significant trade agreements with major U.S. competitors in recent years, notably the CPTPP and the Japan-EU Economic Partnership Agreement. As more economies in Asia and South America continue to join the CPTPP, Japan will continue to diversify trade partners for its food supply. Nevertheless, given U.S agriculture’s reputation for safety and reliability, the United States is well-positioned to continue as the leading agricultural product supplier.

As competition intensifies in the food retail market, crafting a marketing strategy to cater to Japan’s consumer preferences will be essential for U.S. suppliers to remain competitive in a Japanese market that seeks quality, value, and convenience.

1 For additional updates, please see https://twitter.com/USDAJapan/

2 Macroeconomic data in this section, unless specified, is from The World Bank.

3 Import dependence is calculated by dividing imports by domestic consumption. Import and consumption data come from USDA FAS Production, Supply and Distribution Online Data.