New Consumption Trends: Opportunities for U.S. Consumer-Oriented Products in South Korea

Contact:

Link to report:

Macroeconomic Perspective

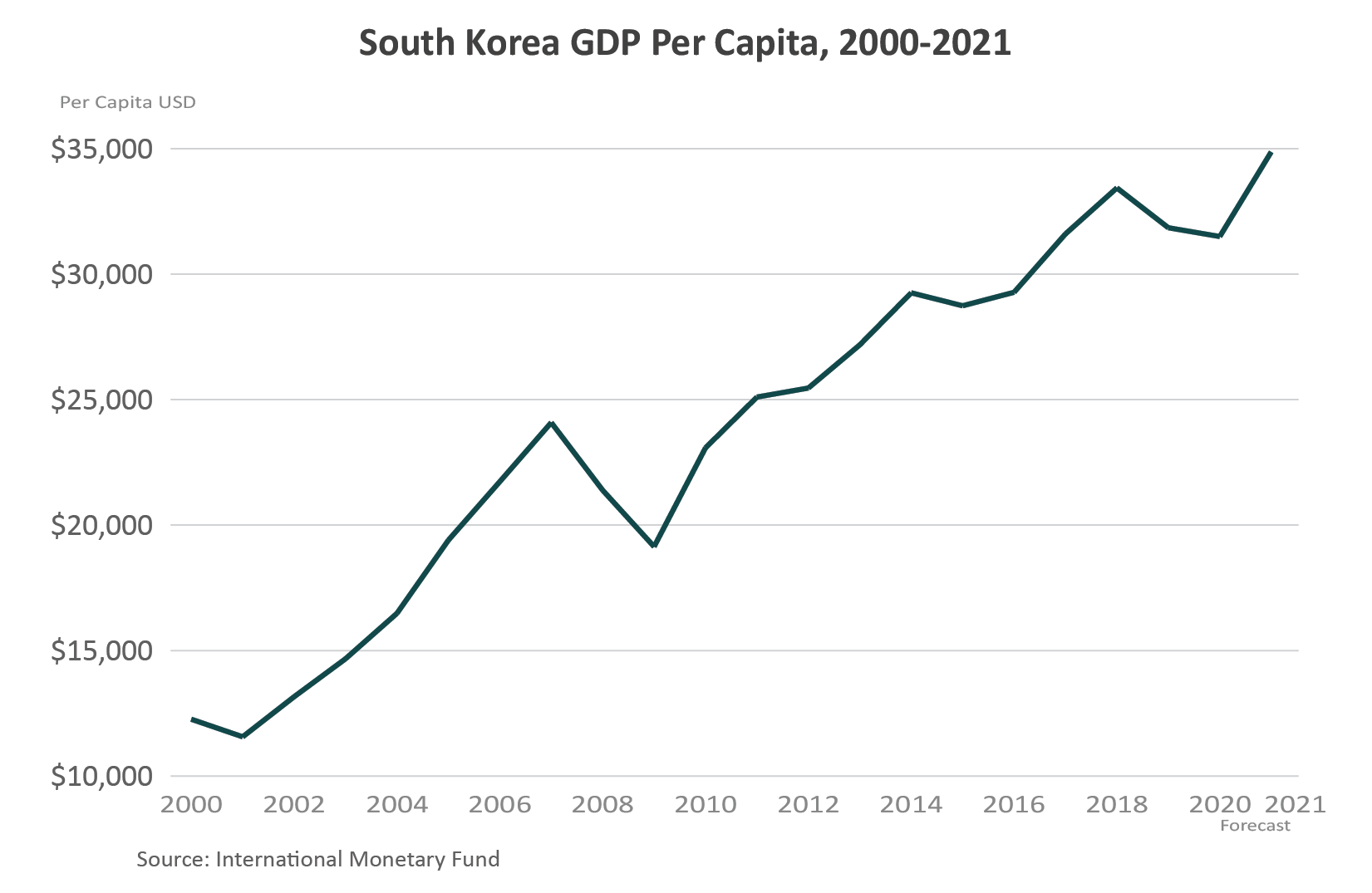

The Republic of Korea (Korea) is a developed Asian country with a global presence in high-tech, automobile, and electronics industries. Korea is an industrial powerhouse with a skilled labor force. It is one of the few countries of the Organization for Economic Co-operation and Development’s (OECD) “30-50 Club,” economies with a $30,000 per capita gross national income and 50 million in population. Although the COVID-19 pandemic hampered the Korean economy in the first half of 2020, Korea has managed the virus relatively well. According to the latest International Monetary Fund forecast, Korea is expected to see a 4.3 percent real gross domestic product (GDP) growth in 2021 after a relatively low GDP contraction of 0.9 percent in 2020.

As Korea’s historical economic growth focused on industry and service sectors-led development, agriculture has played a smaller role in Korea’s economy. Although politically important, Korean agriculture accounts for less than 2 percent of national GDP, according to the World Bank. As a result, Korea’s population is heavily concentrated in urban cities. In fact, Seoul Capital Area, a densely populated metropolitan area which includes Seoul, Incheon, and Gyeonggi Province, makes up approximately half of Korea’s 51.8 million population.

Korea is not only a country where most people live in urban areas and cities, but it also has an aging population. According to IHS Markit estimates, Korea’s population will peak in the 2030s and then gradually decline. Currently at 0.1 percent population growth rate, Korea’s aging and declining population can be attributed to low fertility rate due to socioeconomic factors including high housing and parenting costs, decreasing marriage rates and increasing acceptability of single-person households, and increased women’s participation in the workforce.

Consumption Trends and Market Drivers

Korea is a dynamic market where new trends and products are quickly introduced, tried, and customized to meet consumer needs and to account for changing socio-economic factors. With extensive usage of high-speed internet, consumers are tech-savvy and highly active on online social network sites. This online engagement has contributed to an explosive growth in online retail and food deliveries. According to the Korea Statistics Office, online food and agricultural sales in Korea increased 61 percent in 2020, compared to 17 percent growth in overall online retail sales. Also, online meal delivery orders increased 78 percent in 2020. Several Korean online shopping channels now offer “order by midnight, deliver by dawn” service, where shoppers can order before midnight and have their orders delivered the next morning.

In addition, there has been a growing demand for international food products, as consumers increasingly utilize rising disposable income for dining out and traveling abroad, especially younger generations who learn about the latest international lifestyle trends through social media. According to household income and expenditure data from the Korea Statistics Office, Korean households spend about half of their monthly food expenditures dining out, a trend that will most likely continue. While traditional Korean food products are still staples, diet patterns are shifting, favoring new and international tastes. For example, more consumers are substituting a traditional rice-with-banchan (assortment of side dishes) breakfast with an on-the-go meal of Western-style pastry and coffee.

Another noteworthy trend among Korean consumers is their strong preference for convenience. Single-person households and dual-income households in fast-paced urban cities prioritize accessibility when it comes to food preparation and consumption. As a result, consumers prefer packaged meals and food products that are readily available for consumption. With an advanced food processing sector, Korean retailers are focused on developing and rolling out prepared food products that require minimal cooking time. Adding to the convenience factor is accessibility of retail stores in urban residential neighborhoods. Increasingly operated by top retailers, many convenience stores and supermarkets are located close to apartment complexes and high-foot traffic areas, where some consumers even have the option of in-store shopping but have the products delivered to their homes. These stores, in addition to offering traditional food products and ingredients, have a variety of prepared food products available for consumers.

Korean consumers’ strong interest in and sensitivity to safe and healthy food products is another well-established trend. Used in their everyday language, the term “well-being food” refers to food products or ingredients that are advertised as having functional health benefits. Those products are especially sought after by the fast-growing group of senior citizens, many of whom will continue to work well past 65, and who look to “well-being food” to boost their health. Furthermore, because Korean consumers are conscious about food traceability when dining at a restaurant or grocery shopping, retailers and food service providers have directed their attention to advertising safe and healthy food products from reliable sources abroad.

Prospects for U.S. Agricultural Exports

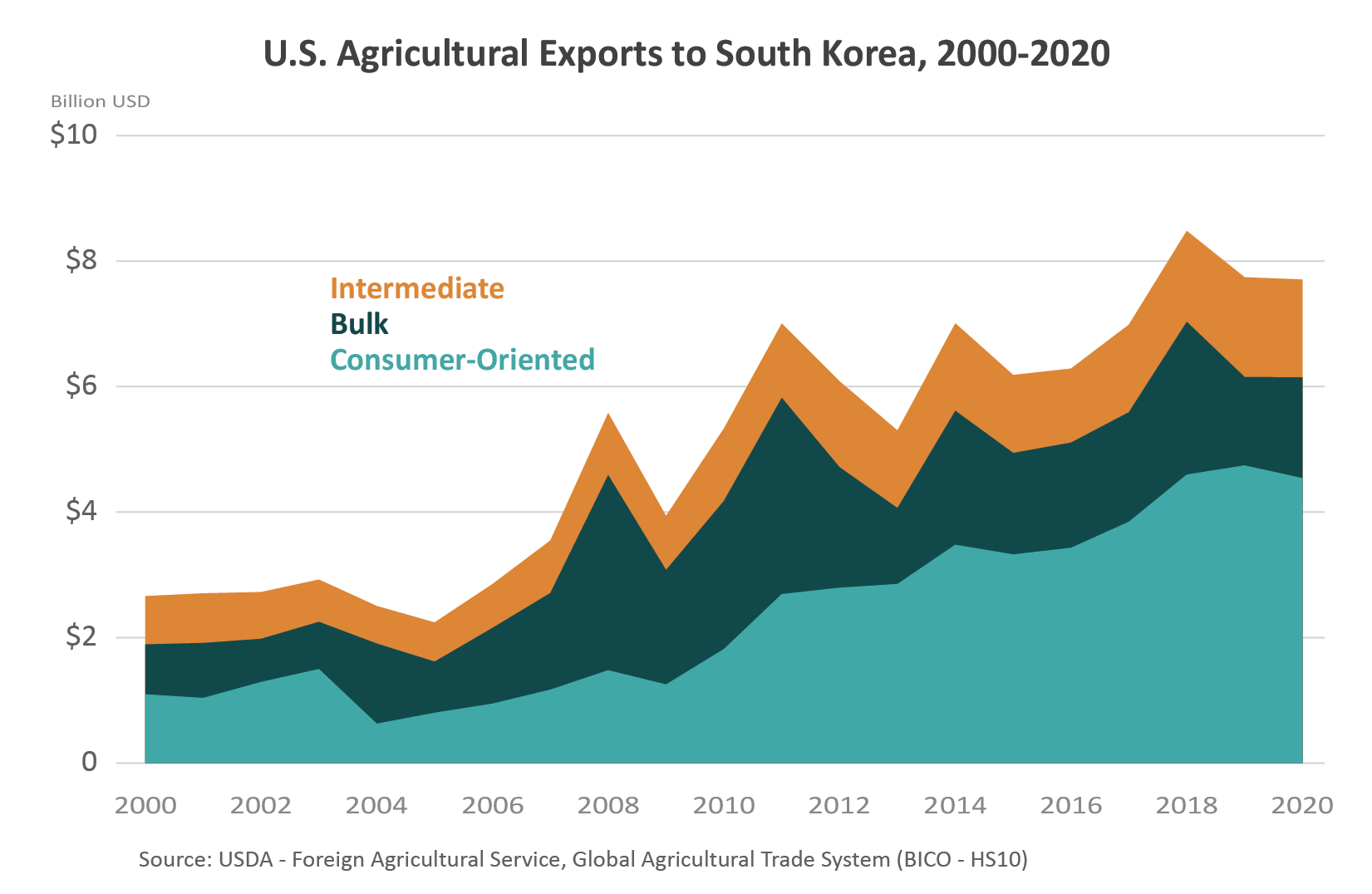

The United States has been a dependable agricultural trading partner of Korea. Recognized as safe as well as of high-quality, U.S. agricultural products have a broad, positive brand image. As the top agricultural supplier, the United States has enjoyed reduced tariff and non-tariff barriers from the U.S.-Korea Free Trade Agreement (KORUS FTA) that went into effect in March 2012. Notably, the share of consumer-oriented products has increased considerably since the KORUS FTA, indicating better access for high-value products for U.S exporters. In 2020, the United States exported $4.5 billion of consumer-oriented products, 58.9 percent of total U.S. agricultural exports to Korea.

Based on market trends, the following products have good growth potential:

Ingredients for Baked Goods: Baked goods have become everyday food items for many Koreans. Western-style pastries at cafés, restaurants, and convenience stores are favorites among young, urban consumers; cakes and other baked goods are enjoyed not only for life-event celebrations but also for regular social gatherings. According to Euromonitor, retail baked goods sales in Korea are forecast to reach $4.4 billion in 2025, a 26.5 percent increase from pre-COVID 2019 levels. With more than 80 percent of the value market share captured by small artisanal bakeries, it is important for U.S. exporters to connect with intermediary distributors and agents.

- Tree Nuts: Health-conscious consumers who want to enjoy baked goods often look for items with tree nuts, less sugar, and organic ingredients. The United States is the leading supplier of almonds and walnuts, first and third largest (in value) tree nuts imports, respectively.

- Berries: Fresh or processed (frozen, prepared, or preserved) berries are essential ingredients in baked goods. In 2020, Korea imported $27.0 million of fresh berries, a 28.1 percent increase compared to 2019. Although Chile is the leading supplier, starting in 2021, U.S. producers enjoy the same zero tariff on fresh berries. The United States also enjoys zero tariffs on frozen strawberries and prepared cranberries.

Cheese: In addition to the rising trend of Korean consumers demanding more international food products, fusion food items that mix traditional Korean cuisines with a Western flare, or vice versa, are on the rise. One key ingredient to much of this fusion is cheese. For example, adding cheese to spicy and flavorful Korean cuisines attracts young consumers. Convenient Western-style delivery food favorites, such as pizza and pasta, have grown in popularity in Korea, especially as indoor dining has fallen amid the pandemic. Since Korea has a free trade agreement with major competitors such as Australia, New Zealand, and the European Union (EU), cheese is priced competitively and is increasingly available to more consumers.

Wine: In 2020, Korea imported $366.8 million of wine and related products, a compound annual growth rate of 10.9 percent from 2010. Because Korea has a limited local wine production, it is a big market for exporters. Publicized health benefits of wine consumption, paired with rising income and evolving food trends, have boosted demand for wine. Also, wine has benefited from the COVID-induced trend of in-home drinking. In order to put a premium on the in-home drinking experience, customers have sought out wine to virtually continue social gatherings and events. Although main competitors such as the EU and Chile have a strong presence in Korea, U.S. wine continues to gain market share. In 2020, the United States saw its highest market share of 15.9 percent.

Despite the global pandemic, Korea’s agricultural imports stayed relatively stable. High-value, consumer-oriented products such as dairy products, tree nuts, bakery goods, and alcoholic beverages did not see reduced demand. Trade data from 2020 suggest that Korea has not only a comparatively stable supply chain to promptly supply retailers and importers, but also a robust middle class where demand for imported agricultural products does not significantly drop due to lower purchasing power. Even though stiff competition remains a challenge, U.S. producers that continue to follow Korea’s dynamic consumptions trends and provide high-quality food and ingredients should have promising opportunities.

Market share and global sales information is from Trade Data Monitor, LLC unless otherwise indicated.