Opportunities for U.S. Agricultural Products in South Korea

Contact:

Link to report:

Executive Summary

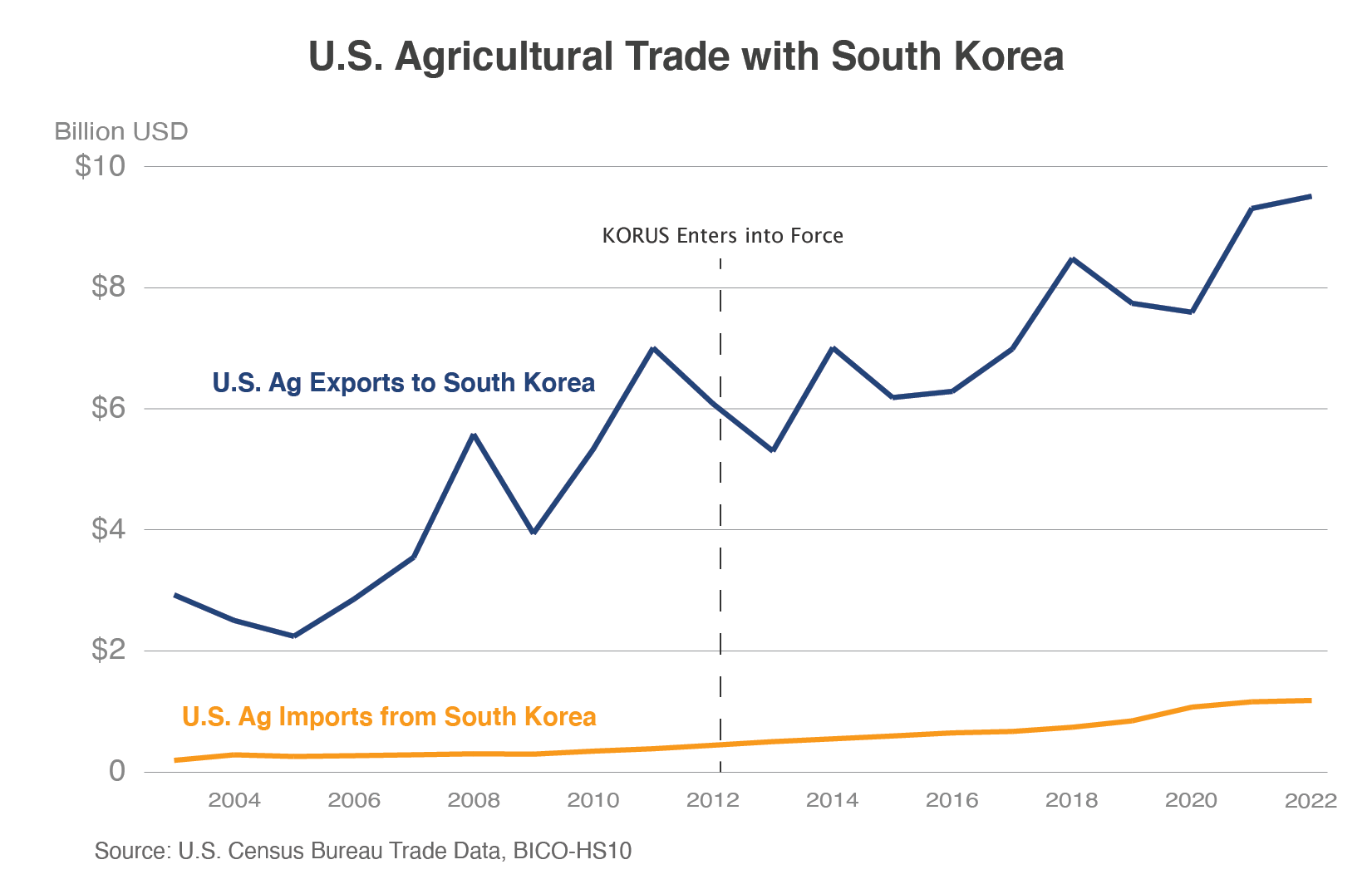

Ample opportunities exist for U.S. agricultural exports to South Korea. Highlighted in the chart above, U.S. agricultural product exports were a record $9.5 billion in 2022, up 2 percent from 2021. South Korea is the sixth largest export market for the United States, thanks in part to a successful free trade agreement (KORUS) between the two countries and a robust demand for high-quality U.S. food products. Top U.S. agricultural exports include beef & beef products ($2.7 billion), pork & pork products ($610 million), dairy products ($569 million), and corn ($508 million). In addition to these top product categories, other U.S. foods have made significant inroads in the South Korean market, including eggs and egg products, food preparations, coffee and related products, distilled spirits, pet food, condiments and sauces, certain fruits and vegetables, and certain vegetable oils, among others.

While U.S. food exports to South Korea were at record levels for the past two years, expectations for 2023 are more tempered. South Korea’s economic growth was a modest 1.4 percent in 2023 due to its declining exports to the world, weakened technology sector (e.g., semiconductors, electronic devices, and computers), high inflation rates, and reduced consumer spending. Furthermore, unfavorable U.S. dollar/Korean won exchange rates have led some South Korean traders to search for more affordable alternative suppliers to meet import demand.

Nevertheless, the outlook for South Korea is more positive for 2024 and beyond with hopes that an economic recovery in China will provide a boost to South Korean exports, and private consumption and investment will gradually rebound.

Bulk, Consumer-Oriented, and Intermediate Products Have Potential to Expand in South Korea

Top South Korean Agricultural Imports from the World (2018-2022)

Value in Million U.S. dollars

| 2018 | 2019 | 2020 | 2021 | 2022 | |

| 1. Beef & Beef Products | 2,908 | 3,127 | 3,123 | 3,806 | 4,507 |

| 2. Corn | 2,126 | 2,348 | 2,366 | 3,218 | 4,270 |

| 3. Soup & Other Food Preparations | 1,402 | 1,725 | 1,927 | 2,182 | 2,297 |

| 4. Pork & Pork Products | 1,840 | 1,695 | 1,461 | 1,812 | 2,135 |

| 5. Dairy Products | 1,165 | 1,249 | 1,399 | 1,651 | 2,051 |

| 6. Wheat | 1,002 | 990 | 970 | 1,349 | 1,787 |

| 7. Processed Vegetables | 1,096 | 1,097 | 1,155 | 1,276 | 1,473 |

| 8. Sugars & Sweeteners | 831 | 825 | 857 | 1,094 | 1,239 |

| 9. Fresh Fruit | 1,345 | 1,232 | 1,195 | 1,324 | 1,213 |

| 10. Vegetable Oils | 558 | 565 | 604 | 916 | 1,111 |

| Total Agricultural Products | 27,927 | 28,029 | 28,633 | 34,997 | 41,065 |

Note: Column totals may not add up exactly due to rounding.

Source: Trade Data Monitor, LLC

South Korea has a well-developed food processing industry, with companies manufacturing a range of products. According to the USDA GAIN report on South Korea’s Hotel, Restaurant, and Institutional sector, more than 31,300 food processing companies in the country generated $69.1 billion in sales in 2021. The retail sector is also robust with sales reaching a record of $106.0 billion in 2021, up 3 percent from the previous year. Additionally, dining out continues to be an important part of the South Korean culture. The country has a vast number of restaurants, including traditional/family, fine dining, café/bakery shops, and international fast-food chains. These industries rely heavily on imported agricultural products and ingredients to meet demand. As shown in Table 1, top agricultural imports are focused on consumer-oriented, intermediate, and bulk products. Also, South Korea’s overall agricultural imports increased by 17 percent in 2022.

The below products are in high demand by the food processing, retail, and restaurant industries:

1. Livestock, Dairy, and Poultry

Beef: Supported by the KORUS agreement, South Korea was the top destination for U.S. beef products in 2022. According to a survey conducted by Gallup in December 2022, South Korea’s perception of U.S. beef has improved significantly during the past decade. Confidence in U.S. beef has risen to 68 percent, compared to 38 percent a decade ago. While there is still a significant and influential domestic beef cattle industry, South Korea relies on beef imports, which accounted for 64 percent of consumption in 2022, to meet its burgeoning demand. South Korean beef imports from all sources reached $4.5 billion of beef products from the world in 2022. The United States is the largest supplier of beef products and holds a 58 percent market share. Australia (33 percent), New Zealand (4 percent), and Canada (4 percent) are other top contributors. In 2022, tariff rates ranged from zero percent to 10.6 percent across different beef products. However, tariff rates and safeguard duties are expected to phase out for all beef products in 2026 and 2027, respectively. South Korean beef imports are forecast relatively flat (by volume) in 2024, as consumer spending is expected to be tight due to economic challenges.

Processed Pork: According to OECD data, South Korea ranks second in the world in terms of annual pork meat consumption at 32.3 kg/capita. Specifically, South Korean consumer purchases of processed pork products have been on the rise during the past two years. In 2022, U.S. exports of processed pork products to South Korea reached $53 million, up 5 percent from the previous year. Most tariffs for U.S. processed pork products have been phased out since 2021. In late 2022, the South Korean government announced a Tariff Rate Quota (TRQ) allocation of 70,000 metric tons of pork. This temporary inflation-fighting policy led to an increase in South Korea’s imports of frozen pork for processing, including imports from Canada and the European Union. As South Korean consumers are price conscious, particularly in their meat purchases, U.S. pork prices will need to stay competitive to maintain market share.

Egg and Egg Products: Egg and egg product imports have good potential to expand in the market. Based on FAO statistics, the egg supply per capita in South Korea increased from 42.77 kcal/capita/day in 2020 to 45.28 kcal/capita/day in 2021. Additionally, South Korean egg and egg product imports from all sources rose from $25 million in 2018 to $41.8 million in 2022. The United States is the second-largest supplier of egg products to South Korea and competes with the European Union (EU) and China. The tariff rates on most U.S. egg products are phased out, including pure-bred breeding eggs, bird eggs in shell, egg yolks, and egg albumin. However, tariff rates on two specific egg products (HS 0407001070 and 0408991000) will phase out in 2026. Although egg and egg product imports have good expansion potential, the market can fluctuate depending on the need for product to offset domestic shortfalls due to highly pathogenic avian influenza (HPAI) outbreaks.

Dairy: In 2022, the United States exported $569 million of dairy products to South Korea, up by 35 percent from the previous year. Cheese, butter, and ice cream accounted for most of U.S. dairy exports. More notably, Buttermilk and yogurt products have made gains in the market. According to Trade Data Monitor, buttermilk and yogurt imports (HS 0403) from all sources totaled $14 million in 2022, up by $1.6 million from the previous year. Buttermilk imports from the United States are subject to a Tariff Rate Quota (TRQ), which increases by 3 percent every year, compounded annually. Currently, the TRQ is at 6,922 metric tons. For yogurt products, the tariff rates have been phased out since 2021.

In addition to buttermilk and yogurt, cheese products also see growth opportunities in South Korea. According to a USDA GAIN report, per capita cheese consumption has increased by 185 percent during the past ten years. Between 2014 and 2022, South Korea’s fresh cheese production dropped 68 percent while processed cheese production increased 242 percent. Domestic cheese manufacturers in South Korea have been introducing new products to the market to boost sales. In terms of specific cheese products, cubed and portion cheese products are popular snacks among adults, and consumption of pizza is on the rise. Soft cheese, ricotta, brie, and other gourmet cheeses have also gained popularity among South Korean consumers. Tariff rates on U.S. blue-veined cheese and cheddar cheese have been phased out since 2021. However, tariff rates on grated, powder, Gouda, Camembert, and Emmental cheese will phase out in 2026.

2. Food Preparations

Soup and other food preparation imports reached $2.3 billion in 2022, up 5 percent from the previous year. The top suppliers are the United States, the European Union, and New Zealand. The United States holds a 51 percent market share, while the European Union and New Zealand claim 19 percent and 5 percent, respectively. Euromonitor found that, due to inflation, South Korean office workers have spent more money towards chilled ready meals. Ordering lunch at restaurants has been too expensive for many consumers. In response, convenience stores have launched new meal subscription services that allow consumers to purchase lunch boxes, soups, and prepared salads. According to Euromonitor, Korean-style soups are becoming more competitive and expected to grow in value. Both Western and Korean-style soup producers are shifting from chilled soup products to shelf-stable products. Tariff rates on most U.S. food preparation products, including soups and beverage bases, have been phased out.

3. Coffee and Related Products

South Korea is one of the largest consumers of coffee in the world. According to the South Korean Ministry of Culture, Sports, and Tourism, the coffee market is expected to reach $6.7 billion in 2023, a 50 percent increase from $4.6 billion in 2016. Also, South Korean adults consume 353 cups of coffee per year. In 2022, South Korea imported $518 million of roasted coffee and extract products, up by $31 million from the previous year. The United States is the largest supplier, followed by Switzerland, and the European Union. In terms of market share, the United States holds 34 percent, while the Switzerland claims 25 percent. Tariff rates on U.S. roasted coffee, coffee husks, and coffee extracts have been phased out since 2016.

4. Distilled Spirits (Whiskey and Bourbon)

South Korean distilled spirit imports have been increasing during the past five years. In 2022, South Korea imported $354 million, of which $28 million came from the United States. The United Kingdom is the top supplier of distilled spirits, followed by the European Union and the United States. Specifically, whiskey and bourbon products have seen strong growth. According to Euromonitor data, South Korea’s whiskey consumption rose from 9.7 million liters sold in 2021 to 14.2 million liters in 2022. In terms of U.S. products, U.S. whiskey and bourbon exports reached $22 million in 2022. U.S. exports by value and quantity increased by 212 percent and 167 percent, respectively. Due to the KORUS agreement, tariffs on U.S. whiskey and bourbon products have been phased out since 2016.

5. Pet Food

As pet ownership has increased significantly in South Korea, more pet owners are demanding high quality pet food, focusing on nutrition and well-being. South Korean pet food imports from the world rose from $239 million in 2018 to $347 million in 2022. China is the top supplier of pet food (30 percent market share), followed by the United States (21 percent) and Thailand (13 percent). According to Euromonitor, domestic and imported pet food products are expected to rise in 2023. The cat population in South Korea is larger than the dog population due to urbanization and an increasing number of single-person and two-person households. The cat population is projected to increase by 4 percent in 2023 while the dog population is expected to grow more slowly. The annual growth rate of the dog population has ranged 3 percent or less since 2019. In terms of cat products, wet cat food, treats, and mixers are expected to see the strongest growth rates. Wet dog food continues to gain in popularity; however, inflation has pushed dog food retail prices up between 10 and 20 percent and has caused dog owners to become more price aware when purchasing product. Dog and cat food originally had a 5 percent tariff rate. With KORUS, U.S. dog and cat food exports enter South Korea duty-free.

6. Condiments and Sauces

South Korea imported $324 million of condiments and sauces from the world, of which $50 million came from the United States. Also, condiment and sauce imports increased from $258 million in 2018 to $324 million in 2022. In a Euromonitor report, South Korean consumers have leaned towards pre-made sauces for ease. South Korean dishes are traditionally made with a complex mixture of many different sauces, including soy and red pepper paste. Euromonitor projects recipe sauces and bouillon to outperform cooking and table sauces amidst inflation. Tariff rates on U.S. soy sauce, ketchup, prepared mustard, bean paste, mayonnaise, instant curry, and brewery vinegar have been phased out since 2021.

7. Fruits, Vegetables, and Nuts

Frozen/ Processed Vegetables: South Korean frozen/processed vegetable imports reached $1.5 billion in 2022, up 15 percent from the previous year. Frozen and prepared potatoes, cassava, and sweet corn account for most of the imports. China is the top supplier of processed vegetables and holds a 57 percent market share. The United States is the second largest supplier with 14 percent market share. U.S. frozen products that have tariff rates phased out include potatoes, peas, beans, spinach, bamboo shoots, and carrots. For prepared/processed vegetables, olives, peppers, capers, and mushrooms enter South Korea duty-free after their tariff rates were phased out. Tariff rates on frozen and prepared garlic will phase out in 2026.

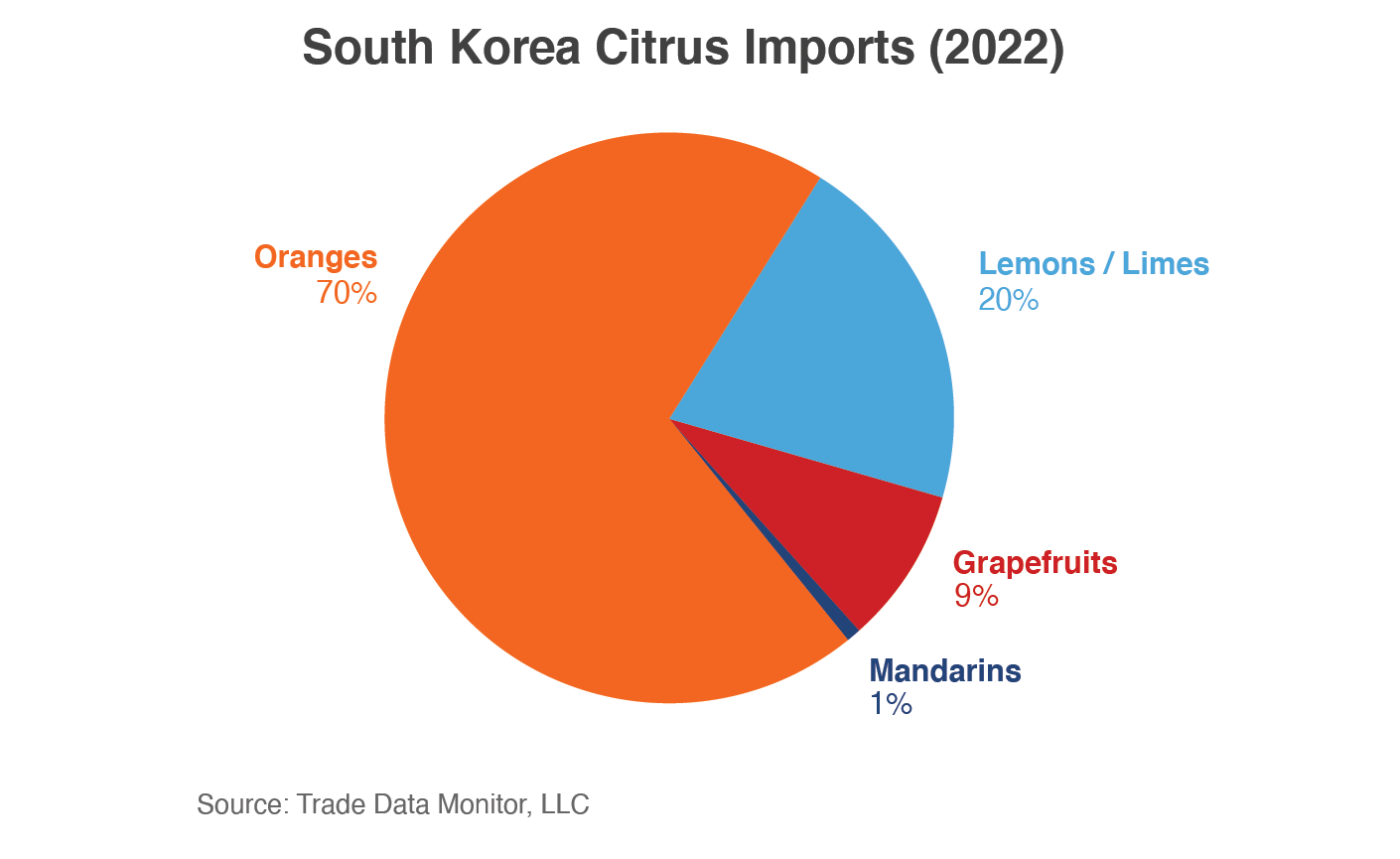

Citrus: In 2022, South Korea imported $234 million of citrus products from the world, of which $193 million came from the United States. Other top suppliers include Australia and South Africa. As shown in Figure 3, South Korea imports mostly oranges, lemons, and grapefruits. Domestic production of citrus (mostly mandarins/tangerines) on Jeju Island remains substantial. Tariff rates on U.S. grapefruit, lemon, citrus aurantifolia, citrus latifolia, and oranges imported between March 1 and August 31 have been phased out. However, oranges imported between September 1 and February 28 are subject to a TRQ that increases by 3 percent every year, in perpetuity. Currently, the TRQ quantity is set at 3,461 metric tons for 2023. The tariff rate on Korean citrus is at 28.8 percent but will phase out in 2026.

Tree Nuts: In 2022, South Korea imported $500 million of tree nuts from the world. Imports have ranged between $465 million and $573 million during the past five years. The top suppliers are the United States, Vietnam, and China. South Korean consumers prefer tree nuts for their health benefits. While almond and walnuts are popular, there is also significant demand for other nuts, including pistachios, pecans, and macadamia. Tariff rates on most U.S. tree nuts, including Brazilian nuts, cashews, almonds, walnuts (no shell), and pistachios, have been eliminated after FTA implementation and rates on other products, including hazelnuts, have been phased out years after. However, import duties on walnuts (in shell), chestnuts, and other edible nuts will phase out in 2026.

8. Vegetable Oils and Soybean Oil

South Korean vegetable oil (excluding soybean oil) imports grew from $558 million in 2018 to $1.1 billion in 2022. Rapeseed, olive, sunflower, and coconut accounted for most of the vegetable oil imports. Likewise, soybean oil reached $615 million in 2022, of which $181 million came from the United States. The European Union, Canada, and Indonesia are the top suppliers of vegetable oils in South Korea. For soybean oil, the United States is the second top supplier, just behind Argentina. However, the United States had been the top soybean oil supplier from 2017 through 2021. The tariff rates on most U.S. vegetable oils, including ground nut, olive, palm, coconut, cottonseed, mustard seed, margarine, and sunflower, have been phased out. However, South Korea has implemented a safeguard duty on sesame oil, which will phase out in 2030. For all types of soybean oil products, tariff rates have been phased out since 2021.

Agricultural Related Exports Are Well-Positioned to Expand in South Korea

Forestry and seafood products are important imports in South Korea. In 2022, imports from all sources amounted to $3.9 billion in forestry products. Wood pellets, plywood, and pine wood are top major forestry imports. South Korea relies on more than 100 countries to meet domestic demand. The top forestry product suppliers are Vietnam, Indonesia, and China, with United States ranking tenth place. Price and suppliers’ ability to meet customer specifications have been major factors in import demand. Tariff rates on U.S. wood products (HS Chapter 44) have either been eliminated after FTA implementation or phased out between 3 to 10 years.

For seafood products, imports reached $6.6 billion in 2022, up from $5.9 billion in 2018. The top suppliers are Russia, China, and Vietnam. South Korean seafood imports are mostly comprised of shrimps/prawns, live crabs, octopus, pollock, and salmon. The United States is the fifth largest seafood supplier in the import market. South Korean consumers generally view U.S. seafood products as high-quality (USDA GAIN Report). Additionally, concerns about seafood safety after the Fukushima water release have worsened and may impact demand for seafood products from neighboring countries. Similar to forestry products, tariff rates on U.S. seafood products were either eliminated after implementation of the free trade agreement or phased out between 3 to 10 years.

KORUS Free Trade Agreement Continues to Support U.S. Agricultural Exports

The U.S.-Korea FTA has proven to be an effective mechanism for promoting economic growth and a win-win for producers and consumers in both countries. The U.S.-Korea Free Trade Agreement entered into force on March 15, 2012, and removed tariffs on two-thirds of U.S. farm and food exports to South Korea. With the free trade agreement, U.S. exporters have enjoyed greater market access with zero tariffs on many products and other tariffs currently phasing out. According to the World Trade Organization, the simple average most-favored nation (MFN) applied tariff rate on agricultural products in South Korea is 56.8 percent.

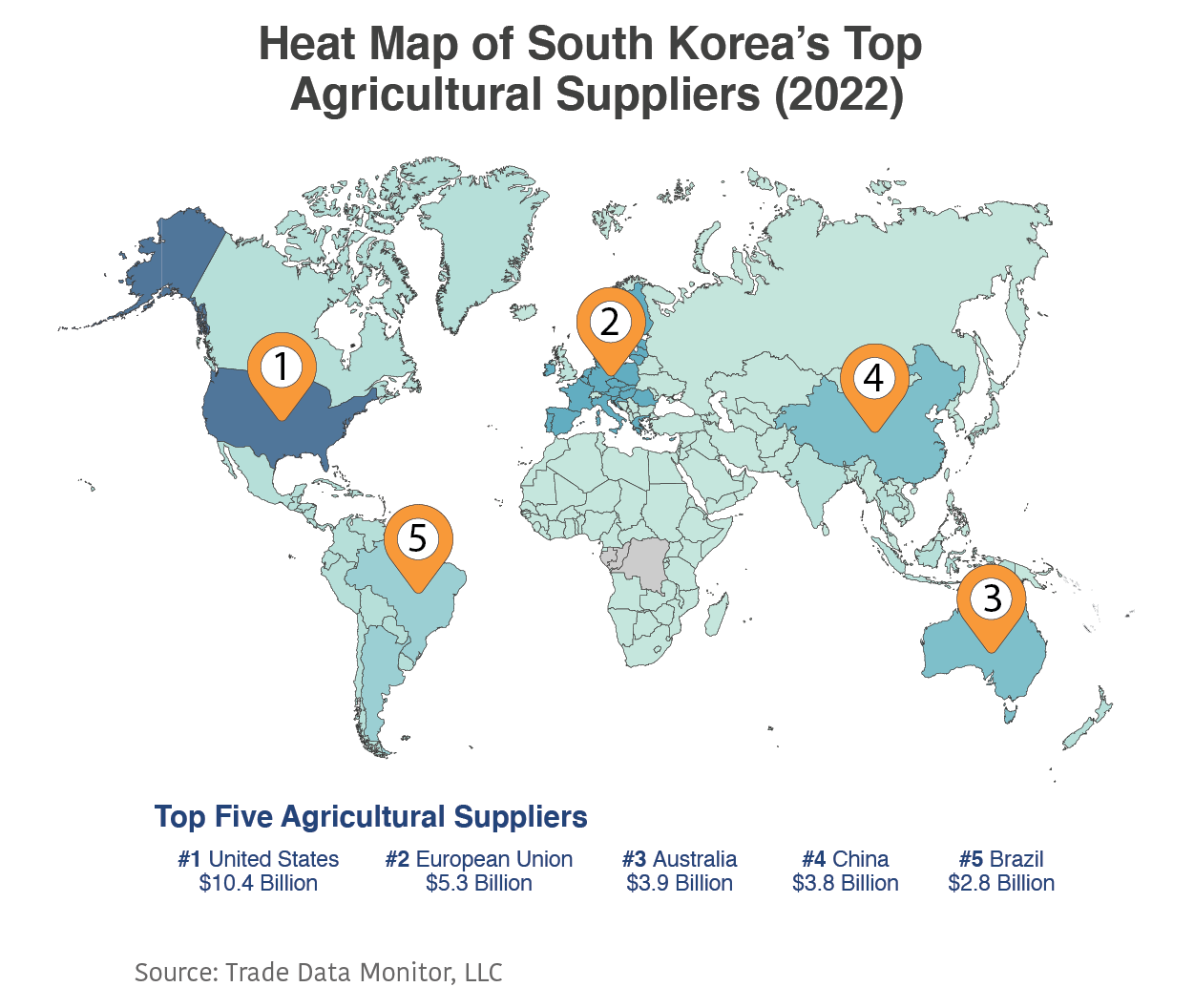

In terms of agricultural product exports to South Korea, the United States competes with China, Australia, Brazil, and Vietnam. South Korea has 21 free trade agreements with 62 countries, including those in the EU. As shown in Figure 4, the United States has been the top agricultural supplier to South Korea and held a 21 percent market share in 2022. However, U.S. market share has declined by 4 percentage points since 2018 due to U.S. competitors that are in proximity and have entered free trade agreements with South Korea. The agreements granted U.S. competitors greater market access to agricultural import markets. The countries and regions include ASEAN, Australia, Canada, some parts of Central America, Chile, China, Colombia, the European Free Trade Association, the European Union, India, New Zealand, Peru, Singapore, the United Kingdom, Turkey, and Vietnam. Additionally, the United States does not have zero-tariff rates for all agricultural products despite having a free trade agreement. However, without the KORUS agreement, the United States would be at a severe disadvantage compared to other major agricultural producing/exporting countries that also have FTAs with South Korea (e.g., Chile, Australia, New Zealand, and the EU) and benefit from low import duties.

Demographics and Macroeconomic Considerations

According to the CIA World Factbook, South Korea is a strong export-driven East Asian economy, with automotive manufacturing leading the industry. Globally, South Korea ranks 14th in terms of real GDP with $2.3 trillion (2021) and a 4.2 percent growth rate (2021). South Korea has a population of 52 million people. South Korea has a rapidly aging population, and the median age has been increasing with a median age of 43.2 in 2020, up from 42.3 in 2018. Also in CIA Factbook statistics, the birth rate for 2023 is 6.65 births per 1,000 people, ranking 224th in the world. These demographic factors have been major influences in food and beverage trends.

South Korea is highly urbanized with more than half of the population living in the greater Seoul area. Additionally, the number of middle-income households is growing and will encourage more demand for food products. S&P Global projects middle-income households to increase from 20 million in 2023 to 22 million in 2033. Also, S&P Global increased its inflation forecast for 2023 from 3.1 percent to 3.4 percent on higher food and energy-related costs from adverse weather conditions and stronger international oil prices. S&P Global projects the inflation rate to decease to 2.0 percent in 2024. Inflation will continue to be a factor for consumer food selection and trends.

South Korea’s Inflation Rate and Forecasts (%)

| 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Consumer price index | 2.5 | 5.1 | 3.4 | 2.8 | 2.4 | 2.3 | 2.1 |

Source: S&P Global

Food and Consumer Trends

According to the USDA Exporter Guide, most South Korean consumers prefer a healthy diet, driven by the rapidly aging South Korean population. There is strong demand for functional food supplements and food products with “perceived” health or beauty benefits. South Korean consumers also value food safety and have advocated for stricter safety regulations. In a Euromonitor survey, 40 percent of respondents say they actively monitor what they eat to manage their weight. Also, due to recent economic challenges and return-to-office mandates, South Korean consumers are looking for inexpensive and convenient food products as inflationary pressures have driven costs higher.

Challenges and Considerations

Certain food imports are subject to strict food safety regulations and lengthy approval processes in South Korea, especially for U.S. biotechnology products. According to the U.S. Trade Representative, the approval procedure for new biotechnology products requires redundant reviews and excessive data requests. Additionally, approvals are managed by five different agencies with each having their own processes and data requests. The United States continues to engage with the Ministry of Trade, Industry, and Energy (MOTIE) and other relevant agencies to streamline the regulatory process. In 2022, MOTIE proposed a draft revision of a regulation that would allow products to enter a pre-review system and to be exempted from a full risk assessment because of certain conditions.

Regarding U.S. beef products, the United States and South Korea reached a bilateral agreement to fully reopen South Korea’s beef import market. However, South Korea continues to enforce a transitional measure, which has remained for 15 years. U.S. beef products must be derived from animals less than 30 months of age. Also, the U.S. beef exporters are prohibited from shipping processed beef products to South Korea, including beef patties, beef jerky, and sausage.

U.S. agricultural products are also subject to maximum residual limit (MRL) requirements. South Korea has a national MRL list (Positive List System) that includes import tolerance for agrochemical residues that were previously permitted but not officially registered for use in South Korea. Outside the list and import tolerance, U.S. agricultural exports are required to comply with a default of 0.01 parts per million. On January 1, 2024, South Korea will not recognize veterinary drug residues for same tissue/similar species and will not accept Codex Alimentarius (CODEX) MRLs for veterinary drugs. South Korea will implement its Positive List System for veterinary drugs in beef, pork, chicken, eggs, milk, and fishery products (USDA GAIN Report).

Conclusion

Despite current economic challenges, South Korea remains a key market for U.S. agricultural products. As South Korean consumer income levels continue to rise, so will their demand for quality and diverse agricultural products. Low tariffs and a well-established knowledge of American products will help ensure the United States remains the top agricultural supplier into the market for many years to come. To further improve the preference for U.S. food in South Korea, U.S. companies should regularly monitor South Korea’s economic situation and food trends and, where possible, improve on price offerings to counter product competition.