Opportunities for U.S. Snack Food and Beverage Exports to Kenya

Contact:

Link to report:

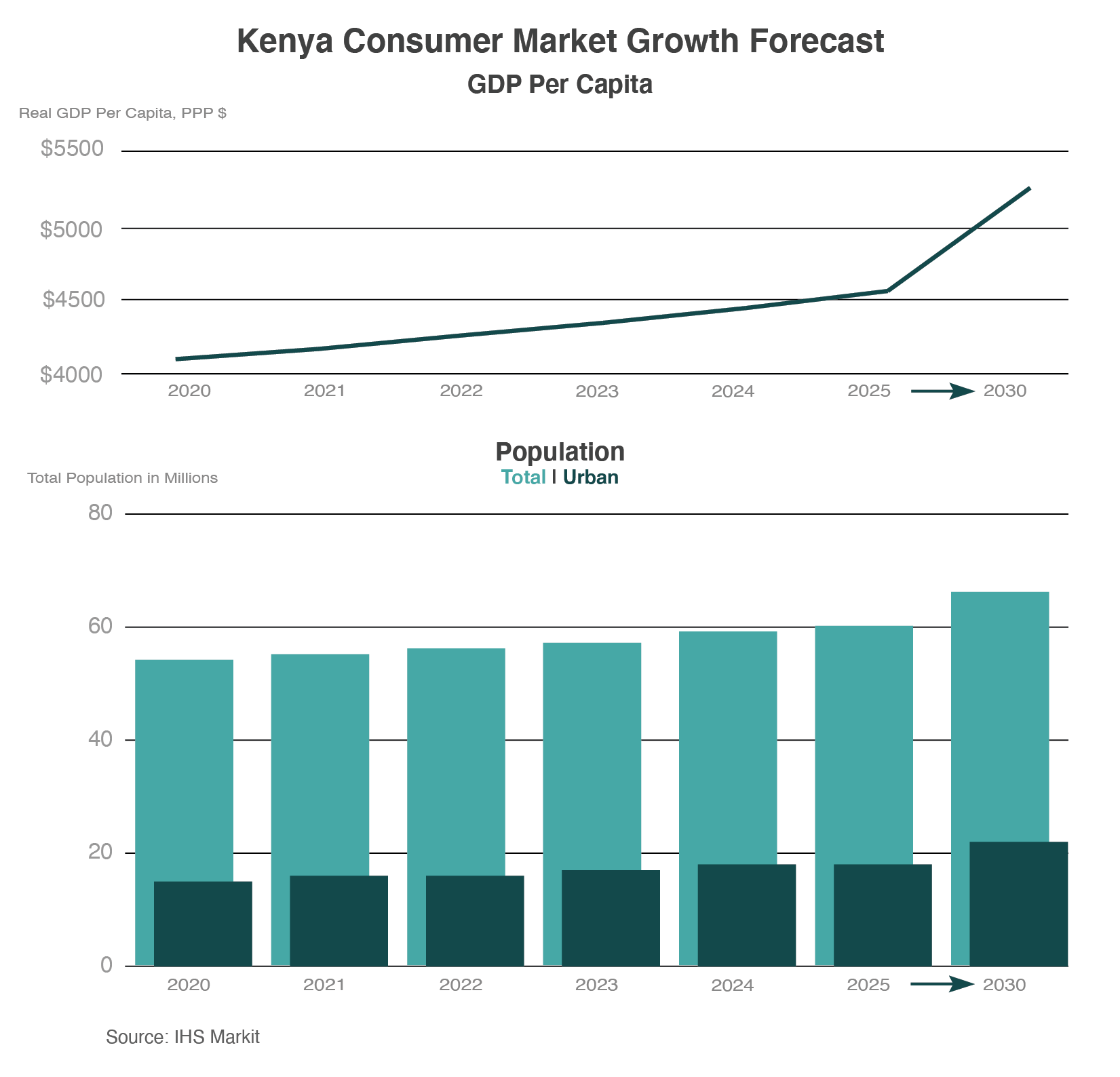

Kenya is a growing middle-income nation that acts as the economic, financial, and transport hub of East Africa. Kenya’s population demographic consists of a median age of 20 years, with 33.8 percent of the population between the ages of 25 and 54 years. Agriculture is the main contributor to the economy with approximately 75 percent of the 54.7 million population working fully or partially in the agriculture sector. Small rain-fed fields and local livestock farms provide more than 75 percent of Kenya’s agricultural output. Given that Kenya is unable to meet its food consumption goals domestically, the country relies on imports to make up the balance. Small plots and low productivity are leading to an increase in urbanization and the demand for imported food. According to IHS Markit, the urban population made up 28.0 percent of the total population in 2020 and is forecast to be 30.6 percent of the total population in 2025. This urban migration, combined with Kenya’s tourism sector gaining steady traction, provides ample market opportunity for increased consumption and imports of snack foods, tree nuts, beverages, distilled spirits, wine, and dairy products.

Macroeconomic Overview

In 2020, Kenya’s gross domestic product (GDP) was $233.4 billion (purchasing power parity constant 2017 international $) with GDP per capita at $4,340. This was a 4.4 percent increase from 2016 to 2021, according to the World Bank. IHS Markit projects a 27.2 percent increase in GDP per capita up to $5,522 from 2020 to 2025. With increased income, rising urbanization and tourism, and the government’s push for diversification in manufacturing and services, Kenya is on the path to importing more food and agricultural products. Food processing is at the top of the government’s development and business initiatives, fueling steady growth of the industry in the last few years. The growth of the food processing sector provides export opportunities for U.S. suppliers.

In 2020, Kenya scored 11.0 out of 12.0 in the World Bank’s Strength of Legal Rights Index, indicating that the country is a desirable place to do business. Kenya outranks high-income nations, whose average sits around 6.1 points on the index. Also in 2020, the credit bureau of Kenya held the highest score in the World Bank’s Depth of Credit Information Index, offering businesses and private citizens the most comprehensive credit information. This achievement not only allocated the most informed financing decisions to interested financial institutions, but it also offers competitive advantages for businesses and corporations looking to do more business in the international market. As a country with strong legal institutions and access to sound financial firms, this gateway to East Africa is well placed to expand imports of convenience foods and ingredients in the manufacturing of domestic processed foods.

Consumption Habits and Competition

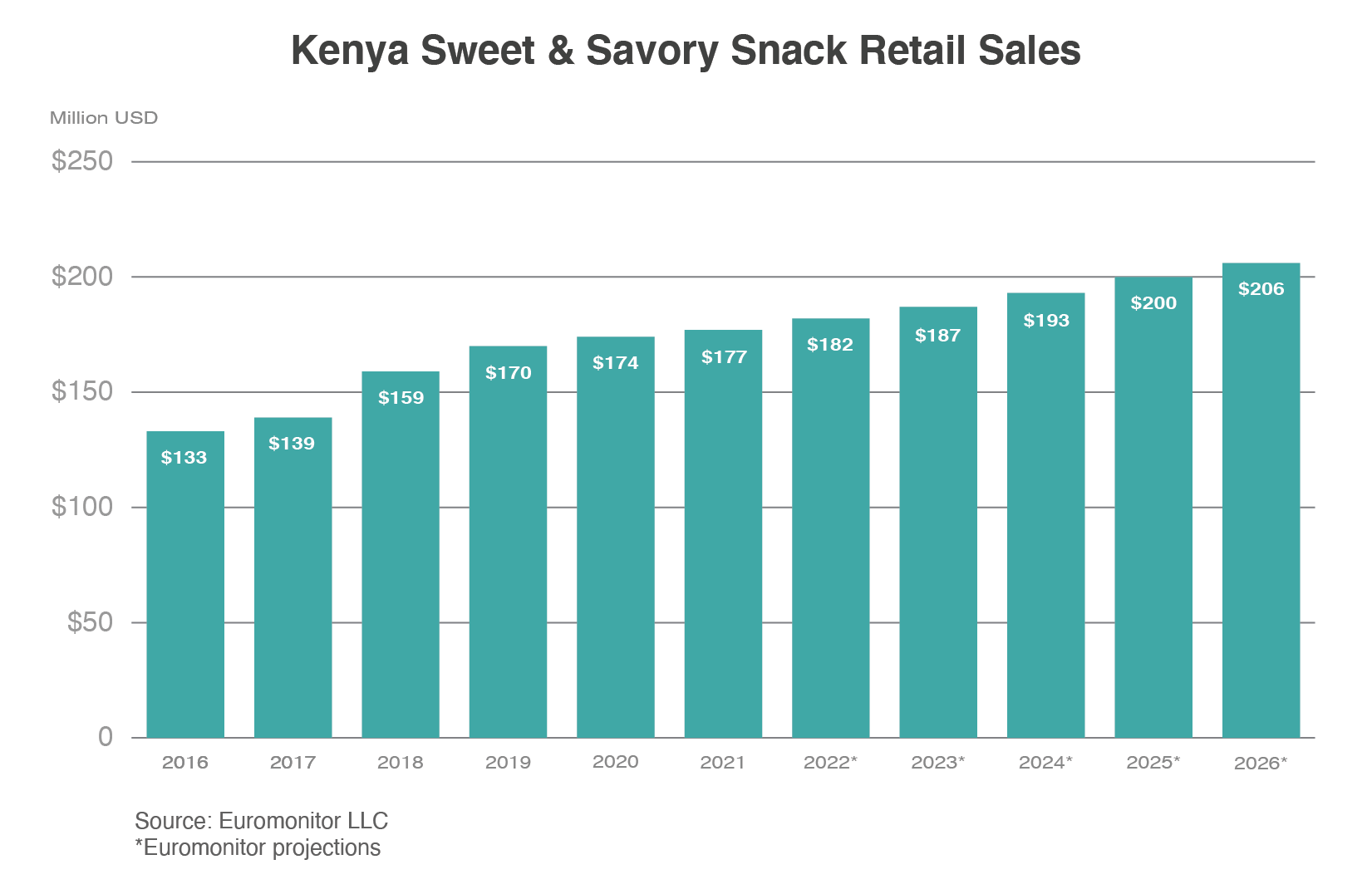

Snack Foods

An increased interest in health and wellness is prevailing in consumer habits regarding snack foods. The Kenyan government went as far as to impose a sugar tax in 2018 and continues to push healthier diets to curb obesity rates. Global imports of snack foods, however, have seen a 20.7 percent 5-year growth rate between 2016 and 2020. Prepared peanuts and peanut butter, as well as mixed nuts and popcorn, have seen the most gains with 36.6 and 14.8 percent growth respectively. The United States sees competition from Uganda, South Africa, Egypt, India, and the United Kingdom because of their proximity to Kenya. Additionally, the East African Community (EAC) and Common Market for Eastern and Southern Africa member states have advantages in tariff rates. U.S. exporters have good growth opportunities in Kenya as U.S. brands are perceived as premium, high-quality goods. As normal habits resume post-COVID, snacking will pick up thanks to on-the-go snacking, a popular trend in Kenya. Considering existing growth opportunities, as well as the high-quality image of U.S. products, U.S. snacks are positioned to be competitive in Kenya and its East African neighbors.

Tree Nuts

The United States dominates the tree nut import market in most countries and Kenya is no exception. The only competitor in the past five years has been India, mostly with miscellaneous nuts, almonds, and walnuts starting in 2017. In the past three years, Kenya has adopted a taste for U.S. pistachios, and there is promise in future demand. The United States has a huge potential market in Kenya as healthier lifestyles become a more prevalent concern for citizens and disposable incomes rise for a growing middle class.

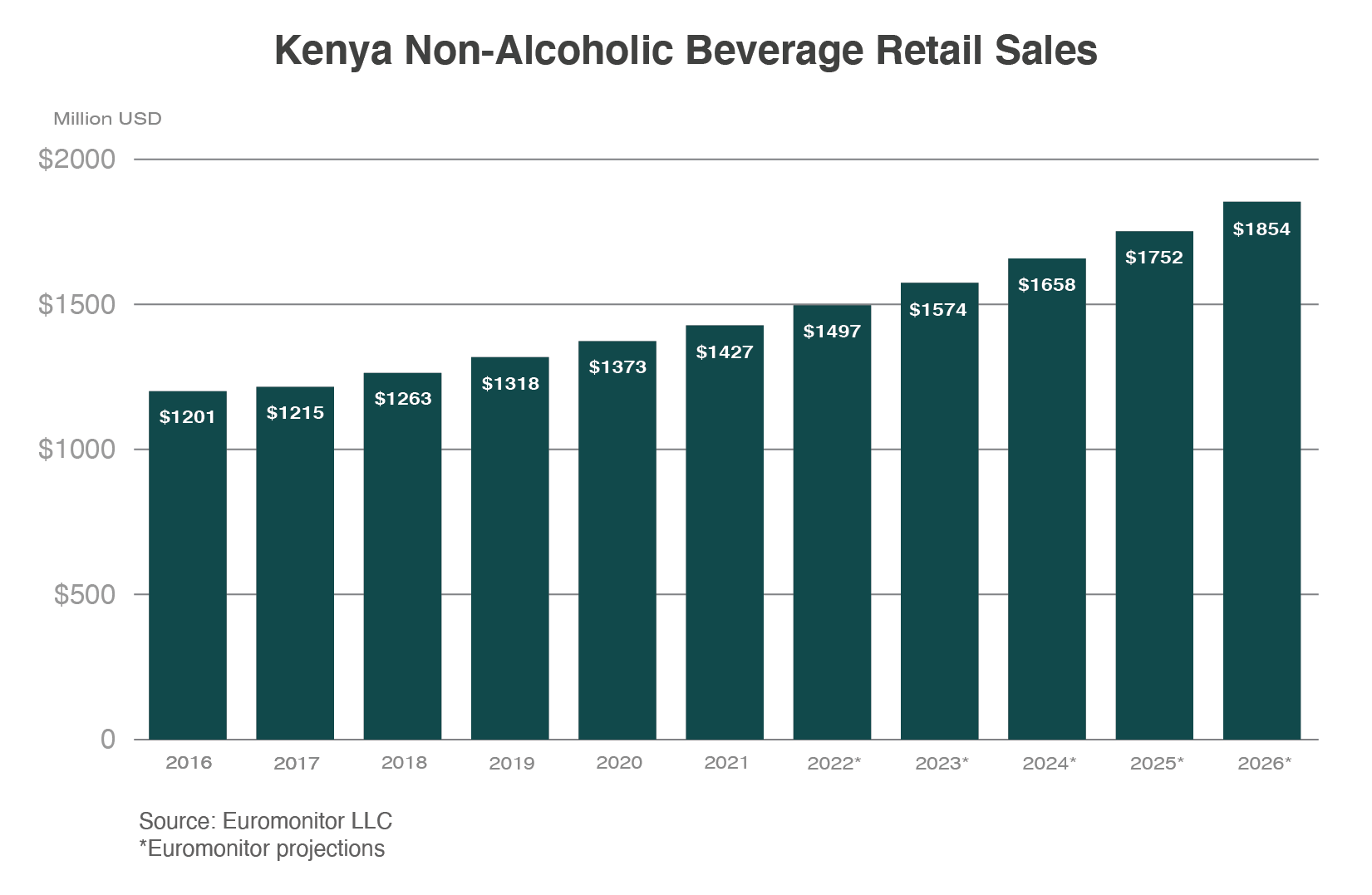

In 2020, Kenya’s manufacturing sector slowed due to the global pandemic. According to the December 2021 Exporter Guide from FAS Kenya, non-alcoholic beverage imports dropped 16.7 percent in 2020. As pre-pandemic behaviors resume, manufacturing is forecast to increase. With a more health-conscious public, Kenya will be looking for high-quality healthy beverage additives and juices. The United States ranks 13th in market share for Kenya imports of non-alcoholic beverages. The U.S. market share comes with a 64.8 percent 5-year growth rate from 2016 to 2020; India has the second highest growth rate at 61.7 percent. This market share growth means that the preference for U.S. commodities in non-alcoholic beverages is increasing substantially. Kenya has imported more bottled drinks (i.e., retail-ready) than any other non-alcoholic beverage product. From 2016 to 2020, Kenya had an 8.6 percent growth rate in bottled drinks with an increase of $3.2 million.

Distilled Spirits

Middle- and upper-income consumers in Kenya are moving away from standard, local, unpackaged, and artisanal spirits. They are seeking more imported premium brands such as bourbon and other U.S. whiskey, tequila (and mezcal), vodka, flavored brandy, and cognac. Consumers demonstrate a preference for sophisticated and imported spirits. Pushing against a 25 percent import tariff, U.S. distilled spirits see the most competition from the United Kingdom, South Africa, Tanzania, and France. Long-term prospects for U.S. spirit sales remain very strong. It is noteworthy that U.S. spirits are widely available in Kenya’s major cities, particularly bourbon, whiskies, and vodka. Since they are largely transshipped through Europe and the United Arab Emirates, they are not reflected in U.S. trade data. With current economic conditions expected to improve, and more consumers trading up to higher-value products, U.S. spirits are positioned to be more competitive in these markets. Suppliers who can strategically consolidate fragmented demands could reduce their transaction costs and potentially become top distilled spirits exporters.

Wine

Wine is becoming more popular with Kenya’s global imports of wine and related products reflected in the 10.3 percent 5-year growth rate from 2016 to 2020. U.S. wines have experienced tremendous growth, more than tripling their value in the same period, reaching more than $250,000 in 2020. With a 25 percent tariff, the United States has some obstacles and competition with South Africa, the EU, and Chile. That said, according to market insiders, U.S. wine has an opportunity to gain traction in Kenya with its distinct wine varietals and flavors.

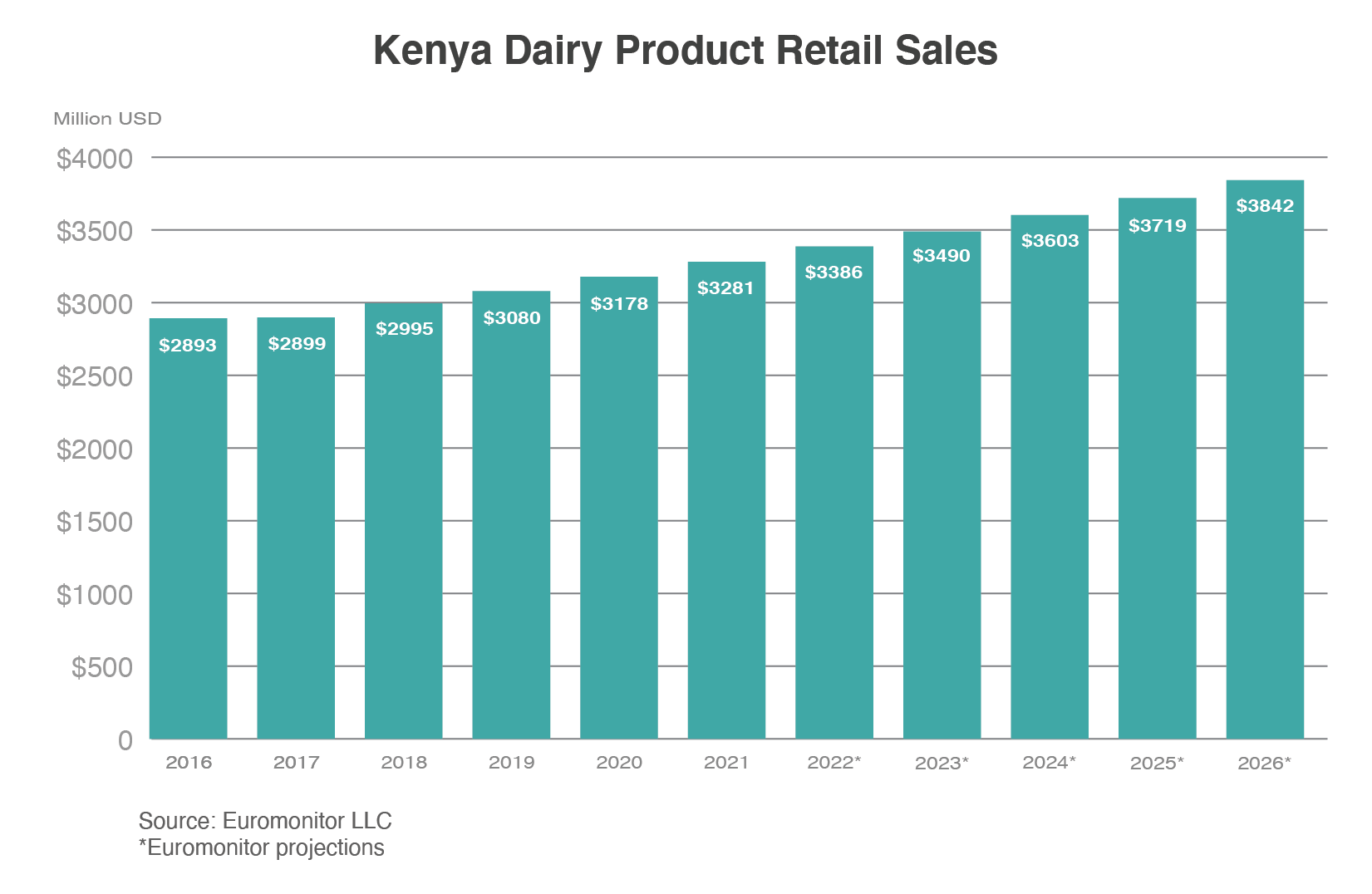

Dairy Products

During the past 5 years (2016 to 2020), Kenya has had a 28.3 percent growth in milk and cream imports. In 2020, there was a sharp decline to $78.6 million. However, milks and creams (for retail sale and for manufacturing) are on the rise and offer ample opportunities for U.S. products. Tariff rates of 60 and 25 percent are obstacles as applied to dairy products; these are considered “sensitive” and “non-sensitive” items under the EAC Customs Union’s Common External Tariff, which Kenya generally follows. Even with tariffs, registrations, and import permits required for dairy products, grocery retailers are beholden to consumer demands. As modern retailers stock imported consumer-oriented high value products to satisfy the demand through eCommerce partnerships with corporations like Jumia, Glovo, Copia, and Uber Eats, Kenya will look for premium quality products. Other products that have seen steady 5-year growth in Kenya’s global imports are dairy preparations for infant use (30.6 percent), casein (39.9 percent), fats and oils derived from milk (69.1 percent) and cheese (12.5 percent).

Looking Ahead

Internet access is transforming Kenya’s infrastructure, with 36 percent of the population now having broadband access and 46.1 percent now having mobile internet access, according to Euromonitor. Kenyans’ use of online shopping and subscriptions soared during the global pandemic, and online ordering and food delivery services show promise as well as food consumption patterns shift towards those of more developed markets. As the United States diversifies its trade partners, it would be beneficial to incorporate Kenya in its expanding markets.