Executive Summary

U.S. beef exports to East Asia in 2022 are again on record pace after a record year in 2021. Despite economic uncertainties due to the COVID-19 pandemic, continued global supply chain challenges, and a competitive global beef market, U.S. beef exports to East Asia, both in value and volume, were outstanding in the first half of 2022. East Asia’s relatively robust middle class has supported the demand for high-quality beef, and a developed e-commerce retail sector has provided flexible avenues for suppliers to promote beef products during the pandemic.

Highlights of U.S. Beef Exports to East Asia

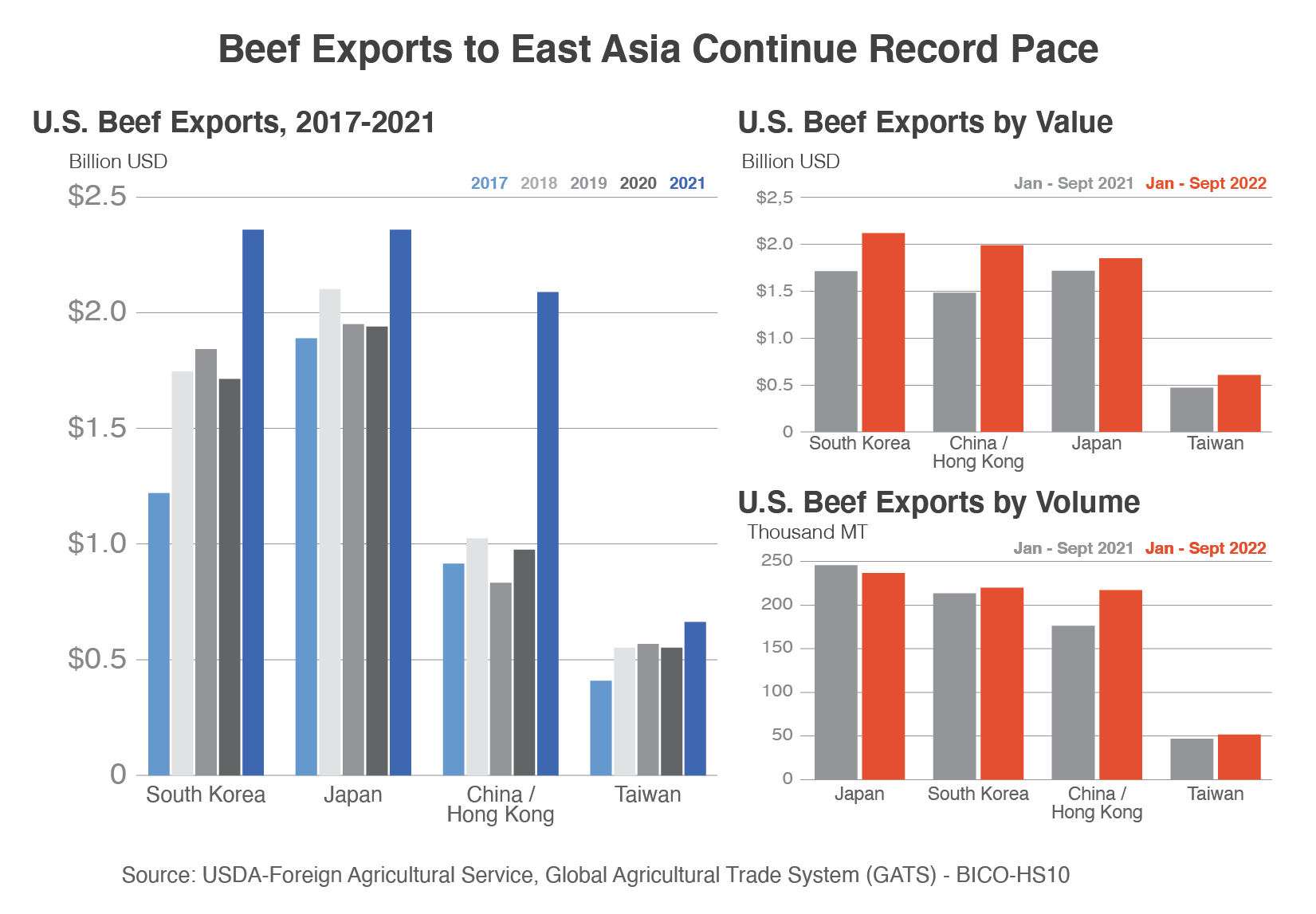

East Asia is the top regional market destination for U.S. beef exports. During the first three quarters of 2022 (January – September 2022), U.S. beef exports to East Asia1, including the Republic of Korea (South Korea), Japan, China/Hong Kong, and Taiwan, were a record $6.6 billion, exceeding last year’s exports of $5.4 billion, a 22 percent increase on a value basis. On a volume basis, exports were up 6.4 percent. Despite surging food prices in recent months, higher-volume shipments indicate a continued demand for beef products and that East Asia’s relatively stable middle class with high disposable household income has been willing to absorb the rising costs.

South Korea: Export value in the first three quarters of 2022 surpassed $2.1 billion, potentially reaching $2.8 billion by the end of the year at the current pace. Strong export performance in 2022 comes on the heels of 2021’s record-setting year, when the United States exported $2.4 billion of beef and beef products to South Korea, surpassing Japan as the United States’ top beef market. After 10 years of a South Korea-U.S. Free Trade Agreement, tariff rates for beef products such as boneless beef, fresh, chilled, or frozen, sit at 10.6 percent. Starting in 2026, U.S. beef products will enter duty-free, and a safeguard duty will no longer apply starting in 2027.

Japan: In 2021, the United States exported $2.4 billion of beef and beef products to Japan, surpassing the $2 billion mark for the second time. From January - September 2022, exports to Japan were up 7.9 percent in value during the past year and shipment volumes have remained steady. Notably, U.S. exports of frozen boneless beef were up 56.0 percent in value and 27.0 percent in volume. In 2021, U.S. beef exports triggered safeguard tariffs; for 30 days U.S. beef had higher tariff rates than Comprehensive and Progressive Agreement for Trans-Pacific Partnership member countries, including Australia. In June 2022, however, the United States signed the U.S.-Japan Trade Agreement with Japan to revise the beef safeguard mechanism. This new agreement protects U.S. exporters’ successful market development efforts by making it unlikely greater beef exports will trigger the safeguard tariffs again in coming years (see USDA FAS New Release June 2, 2022, for more information).

China and Hong Kong: U.S. beef exports to China/Hong Kong surpassed $2 billion for the first time in 2021. Exports in 2022 have already reached $2.0 billion by September 30, a 34.1 percent increase in value during the same period last year; exports on a volume basis increased 23.2 percent. Unlike competition in other East Asian economies, where the United States and Australia are the two main suppliers, in China/Hong Kong the United States competes with several South American suppliers, namely Brazil, Argentina, and Uruguay. China primarily imports frozen boneless beef which supplies the retail sector, and South American suppliers account for more than two-thirds of the market share, both in value and volume. However, there has been strong growth in the fresh or chilled beef market, which primarily supports China’s growing hotel, restaurant, and institutional (HRI) sector. Australia and New Zealand remain top suppliers, using proximity and free trade agreements to their advantage.

Taiwan: Beef exports to Taiwan continue to thrive after a record year in 2021 ($662.7 million). September 2022 data shows exports were up 28.7 percent on a value basis and 10.7 percent on a volume basis. Temporary reductions in beef tariffs in 2021-22 have been advantageous to U.S. exporters while Taiwan’s reopening the country to foreign visitors is a promising sign for the HRI sector.

Looking Ahead

From a policy perspective, how economies combat inflationary pressure will have an impact on East Asia’s demand for beef imports. Consumer price data from the Organization for Economic Co-operation and Development shows food prices continue to rise in East Asia, particularly in South Korea and Taiwan. Recent policies, such as the temporary reduction in beef import tariffs in Taiwan and duty-free beef imports in South Korea (100,000 metric tons), which go through the end of 2022, show how policies to address rising food prices can support market access opportunities for U.S. exporters.

Despite economic shocks and uncertainties during the last several years, no strong indicators suggest the softer global economic environment has weakened beef demand in East Asia. In spite of supply chain disruptions for U.S. fresh or chilled beef, longer shipping times, and higher costs, import demand for beef products should remain steady. The most successful companies will adopt their marketing strategies to reflect East Asia’s quickly evolving and ever-changing consumption and retail trends.

1 Due to relatively low trade volumes, Macau and Mongolia were not included in this report.