South Korea 2020 Export Highlights

Top 10 U.S. Agricultural Exports to South Korea(values in million USD) |

|||||||

| Commodity | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 % Change | 2016-2020 Average |

| Beef & Beef Products | 1,071 | 1,220 | 1,746 | 1,843 | 1,722 | -7% | 1,520 |

| Corn | 864 | 705 | 1,356 | 359 | 548 | 53% | 766 |

| Prepared Food | 365 | 324 | 355 | 509 | 460 | -10% | 403 |

| Fresh Fruit | 389 | 493 | 494 | 405 | 459 | 13% | 448 |

| Pork & Pork Products | 364 | 475 | 670 | 593 | 453 | -24% | 511 |

| Dairy Products | 231 | 279 | 290 | 330 | 370 | 12% | 300 |

| Soybeans | 227 | 294 | 327 | 396 | 361 | -9% | 321 |

| Wheat | 248 | 328 | 363 | 300 | 340 | 13% | 316 |

| Tree Nuts | 296 | 306 | 290 | 291 | 295 | 2% | 295 |

| Feeds & Fodders | 152 | 158 | 157 | 202 | 235 | 16% | 181 |

| All Other | 1,976 | 2,290 | 2,265 | 2,296 | 2,287 | 0% | 2,223 |

| Total Exported | 6,183 | 6,872 | 8,313 | 7,524 | 7,530 | 0% | 7,285 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

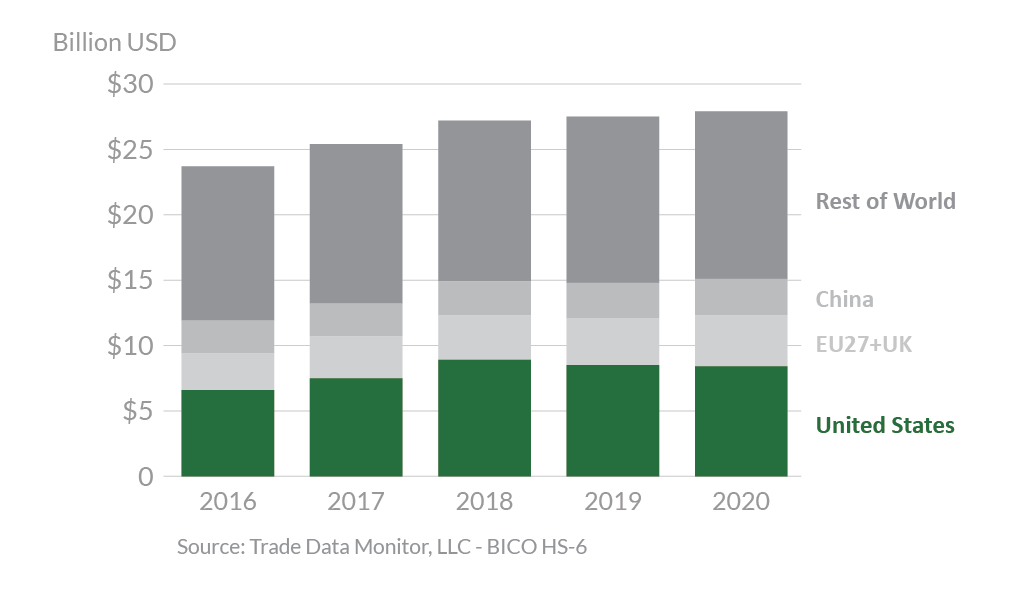

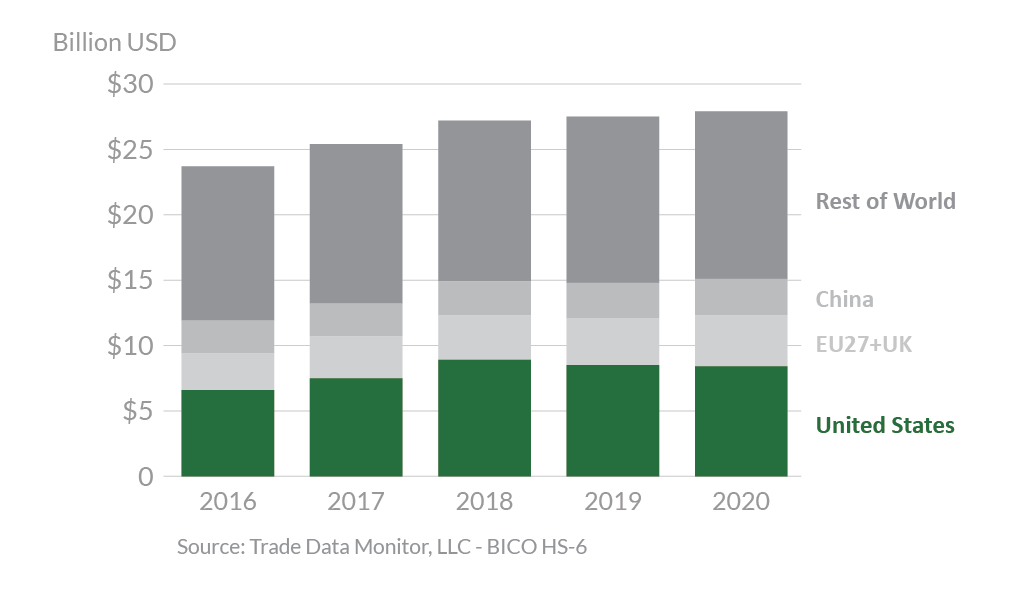

South Korea kept the No. 6 position in the U.S. agricultural export market at $7.5 billion in 2020, representing a fractional increase from 2019. The United States is South Korea’s top supplier of agricultural products by a large margin, occupying a 30-percent market share. The EU27+UK and China are the second and third largest suppliers with 14 percent market share and 10 percent market share, respectively. Under the United States–Korea Free Trade Agreement (KORUS), South Korea eliminated tariffs on almost two-thirds of U.S. agricultural exports. U.S. agricultural products now entering South Korea duty-free include wheat, corn, soybeans, hides & skins, cotton, cherries, pistachios, almonds, orange juice, grape juice, and wine. Other agricultural products receive duty-free access under tariff-rate quotas (TRQs), including skim & whole milk powder, cheese, dextrin, modified starches, barley, popcorn, oranges, potatoes, honey, and hay. The commodities which experienced the largest value growth in 2020 were corn with a 53-percent increase, wheat with a 13-percent increase, fresh fruit with a 13-percent increase, and dairy with a 12-percent increase. On the other side, reductions were seen in pork (24 percent), prepared foods (10 percent), and beef (7 percent). South Korea remained the top U.S. export market for soybean oil, fresh oranges, and fresh cheese in 2020.

Drivers

- Although the COVID-19 pandemic slowed some global exports to South Korea in 2020, it is expected that the country’s overall imports will rebound with an anticipated recovery from the pandemic.

- U.S. beef exports continue to drive trade to South Korea. As the second-largest foreign destination for the U.S. beef industry, South Korea’s preference for high marbling and competitive pricing will continue to grow demand for high-quality U.S. beef.

- With South Korea’s dependence on large-scale agricultural imports to satisfy food demand, U.S. high-value, consumer-oriented products will continue to experience growth, particularly since KORUS provides U.S. exporters a price advantage.

- South Korean demand for U.S. pork is expected to improve as the food service business recovers from the COVID-19 pandemic.

South Korea’s Agricultural Suppliers

Looking Ahead

South Korea remains one of the largest destinations for U.S. agricultural exports. The U.S. trade value to South Korea is expected to remain positive in 2021. Rising incomes and a growing, advanced economy continue to fuel consumers’ appetite for quality U.S. agricultural products. Moreover, the advantages of KORUS will continue to stimulate demand as the agreement passes its 10-year anniversary and tariffs are further reduced for a wide range of agricultural products. The year 2020 was the first full year of implementation for the country-specific quota (CSQ) established under the World Trade Organization (WTO) rice tariffication agreement that was signed between the United States, South Korea, and four other WTO member countries in 2019. This CSQ offers U.S. exporters predictability by committing South Korea to import a fixed volume of at least 132,304 metric tons of U.S. rice annually and establishing transparent disciplines for South Korea’s administration of the U.S. CSQ in the years to come.