Soybean 2020 Export Highlights

Top 10 Export Markets for U.S. Soybeans(values in million USD) |

|||||||

| Country | 2016 | 2017 | 2018 | 2019 | 2020 | 2019-2020 % Change | 2016-2020 Average |

| China | 14,203 | 12,224 | 3,119 | 8,005 | 14,159 | 77% | 10,342 |

| EU27+UK | 1,899 | 1,637 | 3,078 | 1,953 | 1,940 | -1% | 2,101 |

| Mexico | 1,462 | 1,574 | 1,818 | 1,878 | 1,895 | 1% | 1,726 |

| Egypt | 100 | 364 | 1,164 | 995 | 1,475 | 48% | 820 |

| Japan | 1,000 | 973 | 927 | 971 | 1,063 | 10% | 987 |

| Indonesia | 988 | 922 | 998 | 864 | 884 | 2% | 931 |

| Taiwan | 579 | 586 | 854 | 685 | 604 | -12% | 662 |

| Thailand | 362 | 467 | 593 | 524 | 568 | 8% | 503 |

| Bangladesh | 228 | 391 | 434 | 388 | 481 | 24% | 384 |

| Vietnam | 341 | 288 | 469 | 262 | 420 | 60% | 356 |

| All Others | 1,678 | 2,029 | 3,603 | 2,138 | 2,192 | 3% | 2,328 |

| Total Exported | 22,839 | 21,456 | 17,058 | 18,663 | 25,683 | 38% | 21,140 |

Source: U.S. Census Bureau Trade Data - BICO HS-10

Highlights

In 2020, the value of U.S. soybean exports to the world reached a record $25.7 billion, up nearly 40 percent ($7 billion) by value and up 23 percent (11.9 million tons) by volume from the prior year. Exports to China jumped $6.2 billion (up 77 percent) from last year, significantly contributing to the rise in total exports. The total value of U.S. soybean exports was more than $4 billion (18 percent) above the 5-year average of 2013-2017.

Drivers

- Tightened U.S. soybean supplies, partly due to higher export volumes and lower stocks, pressured prices up in the last few months of 2020.

- Recovery from African swine fever and restocking in China raised global demand for soybeans.

- Shipments to Egypt, our fourth largest partner, jumped nearly 50 percent.

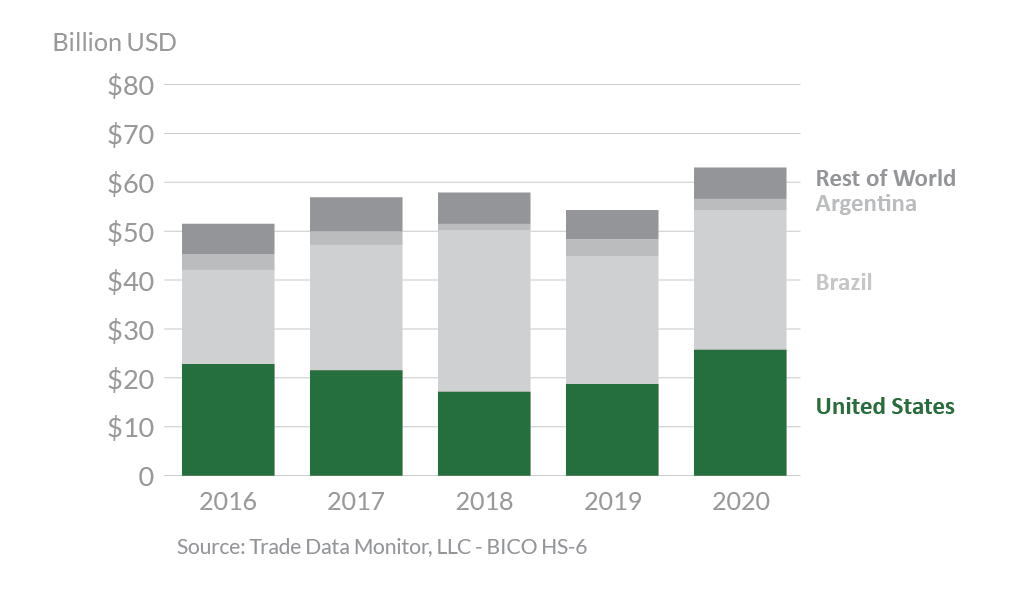

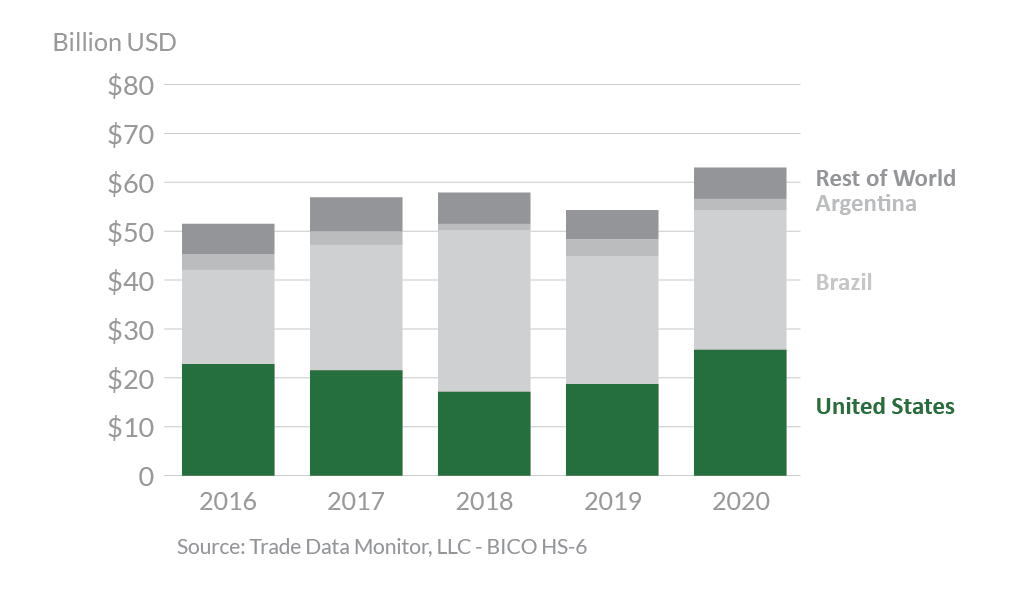

Global Soybean Exports

Looking Ahead

U.S. soybean exports are forecast at record levels for the marketing year ending in August (2020-2021). Soybean shipments are back on trend this MY with large sales being shipped out in late 2020 and early 2021. Sales are expected to drop during the normal South American shipping season. Surging demand from China as it rebuilds its stocks and the swine sector recovers from ASF have led to record shipments early in 2020-2021 compared to the same time period in prior years. As of early February 2021, 33.9 million tons have been shipped to China and another 1.9 million have been sold awaiting shipment. The United States will continue to face competition from Brazil, the largest exporter of soybeans. Exports to the EU27+UK are expected to remain steady as total commitments are at similar levels to last year, while exports to Mexico are expected to rise as total commitments are up 25 percent.